Investment real estate gets preferential tax treatment from the IRS -one that is not afforded to any other asset class. In a nutshell, if you hold real estate long term, you are allowed to deduct a “paper” expense called depreciation from an appreciating asset. It’s yet another way that real estate makes you money by letting you keep more of it after it goes through the government strainer. But in speaking with many investors (aspiring or active) there seems to be this gross misconception that due to the ability to deduct depreciation, cashflows from investment real estate are tax free. So, today I wanted to dispel this mistaken notion and give you a clear idea on how investment real estate income is taxed.

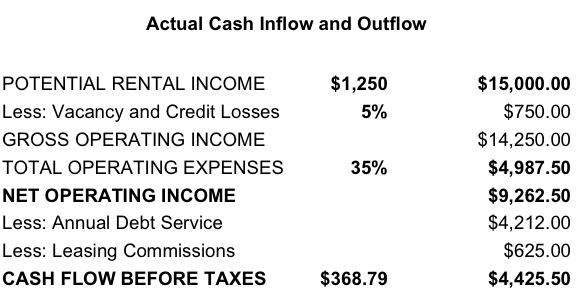

You’re pretty much allowed to keep two sets of books – legally. One is the actual cash inflow and outflow set. The other is the tax inflow and outflow set. So let’s look at some numbers as an example:

If these were the numbers on a different asset class and the investor was in the 30% tax bracket, they would owe $1327.65 in taxes making their after tax cashflow $3,097.85. But this is long term real estate, so here’s what the inflow and “outflow” look like for tax purposes:

As you can see, for tax purposes, you are allowed to deduct just the interest portion of your mortgage payments as well as the depreciation expense, leasing commissions and loan cost amortization. This results in a much lower taxable income which in turn results in 36% lower taxes or $854.25. The depreciation expense that the IRS allows real estate investors to deduct shelters a portion of your cashflow from taxes. Put a different way, instead of paying taxes at your bracket rate of 30%. you’re paying taxes at a 19.3% rate. I don’t know about you but any steps closer to zero (my favorite tax rate) are fine with me.

So back to the misconception. Investors tend to look at their cashflow figure then at the depreciation expense which leads them to believe that most (or all) of their income will be sheltered from taxes. However you aren’t allowed to deduct the portion of your debt service (mortgage payments) that goes towards principal and therein lies the rub. So it isn’t tax free but tax favorable. Something most other assets classes can’t claim.

![]() John Morgan via Compfight

John Morgan via Compfight

Any thoughts on depreciation recapture’s impact on the return?

Good question, Jeffrey. Depreciation recapture comes into play when you exit the investment and decide to keep the proceeds instead of doing a like kind (1031 Exchange). In a nutshell, all the accumulated depreciation expense that gave the investor shelter over the years gets recaptured and taxed at a 25% rate. More often than not, the investor will be at a much higher tax bracket by that time so even in that case, 25% is considerably lower than the ordinary income rate it would be charged otherwise.

I like to say that tax laws with regards to investment real estate operate similar to a tollway. They might let you get into the road for free – sometimes they’ll even let you skate without paying a toll for a while but you can bet that there will be a toll booth when you exit. 🙂

If you wanted to avoid the taxes on depreciation recapture for the time being you trade into another asset thus deferring the taxes further into the future. But that may not always be the smartest thing to do for two reasons: a) When you look at the internal rate of return of an investment (not just the cash on cash) the after tax return on a properly executed investment still rocks and you get to start over on your next property with a fresh basis b) If you play your cards right and have someone on your side to advise you properly, you may get to that exit point and have a bunch of paper losses to offset some or all of that gain.

Makes sense?

What if you sell at a loss, do you owe any taxes? Thanks

What if you file BK chapter 11 or property forclosed? What tax consequences in both cases.