Real estate investors usually catch “flipping fever” because they believe that’s the fastest way to make the most money investing in real estate. To paraphrase some of our past clients with this “condition”, investing in real estate long term is just too little, too slow. Instead – they argue – they would rather make the big bucks now and double their capital in a flash by flipping homes. Turns out, those bucks are much smaller than they appear.

I could try to talk you about the pitfalls of flipping homes till I am blue in the face and still I couldn’t match the story that the numbers tell.

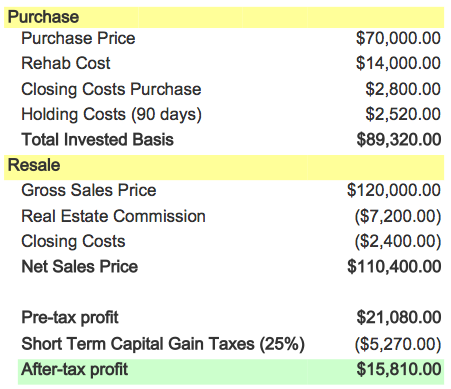

Optimistic Scenario

It’s a beautiful day, birds are chirping, grass is green and nothing ever goes wrong. You find and purchase a property according to the formula commonly used by investors that flip homes: 70% of After Repaired Value (ARV) minus the cost of repairs. Property’s market value after $14k in repairs is $120K and your purchase price is $70,000. You complete the rehab on time, on budget and now the home is ready to be placed on the market for sale. Since fortune is on your side, an end user falls in love and buys your flip for full asking price closing 90 days later. So let’s do a little math:

So let’s recap: If you buy the property for the exact right price and rehab it on time and on budget, sell it for full asking price in 60-90 days with no concessions or hiccups whatsoever, your after tax profit is about $15K. Next, let’s look at a more Earthly example.

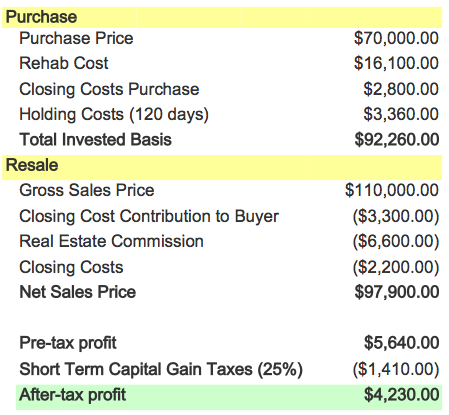

Realistic scenario

Now we’re looking at the same property as before but instead of the vacuum projected by our rose colored glasses, we’ll introduce some realistic dynamics that happen during the process. Halfway through the rehabbing process you realize that there will need to be more work done than you previously estimated. After all is said and done, you are 15% over budget and a couple of weeks past your repair completion goal but hey, it’s done and ready for sale. Forty-five days on the market and the Realtor says there have been many showings but no real interest. Being the reasonable investor you are, you drop the price $5k to seek an offer. A month and a half later you get the call you’ve been waiting for. A buyer is interested but due to the market being a little soft, he offers $5K below your new asking price and wants you to pay 3% of his closing costs. Happy and ready to get this over with, you take it and 30 days later, Ka-ching. Or is it?

Well, would you look at that? Throw in going slightly over budget on repairs (which happens, oh, every other flip) and realistic contract negotiations and profit plummets by 70%.

Now do I really need to show you a pessimistic example where Murphy shows up? I didn’t think so.

Don’t make a Gross mistake

What creates the illusion of big profits in flipping homes is an incorrect focus on Gross numbers. Investors look at the After Repair Value then they glance at the acquisition price and think they’ll be making a killing. But when you actually dig deep and account for all costs, the odds are not in your favor. Not even close. The best way to evaluate a deal like this is to look at the upside vs. the downside potential of the deal. In this case study, best case scenario (upside) you make $15K in profit. Worst case scenario (downside) you lose money. If you were a risk taker, that upside doesn’t justify the downside. If you’re a prudent investor, this makes absolutely zero sense.

There’s a better way, folks. A much better way. And I’ll start to lay out the foundation for it with my next post that will answer the question: What does the ideal long term investment property look like?

Stay tuned.

Photo Credit: Shyb

Pingback: Flipping vs. Long Term Investing - Why it's not even a close contest

Pingback: Avoid These Common House Flipping Mistakes

Pingback: Becoming a Real Estate Investor: Important Considerations for Flippers