There comes a point in the life of every long term real estate investor where he has to make a critical choice. He has been cruising along assembling this great portfolio of real estate investments when he reaches a fork in the road. The question is, do you go left or right? That decision can be the drastic difference between losing everything or retiring early. Do you know which way to turn?

![]() Photo Credit: Frans Persoon via Compfight

Photo Credit: Frans Persoon via Compfight

Case and Point

Let me paint a picture for you to illustrate exactly what I mean. Let’s say that it has been a good year for your real estate investing aspirations and you have been able to purchase three solid investment properties with all the right qualities. Properties were rented out within weeks of hitting the market, they are cash flow positive and you are enjoying the sweet fruits of success. You purchased them with 20% down and took advantage of never-before-seen low interest rates to leverage your capital and increase the value of the assets you control. This is where you see the fork in the road that presents you with two choices. If you turn left, you purchase more properties, leverage your capital even further and pursue an increase in positive cash flow until you reach your desired income level. If instead you turn right, you use the positive cash flow from the properties along with additional capital of your own to pay off the mortgages on the properties in your portfolio. The answer is as much a question of math as it is a question of investing philosophy. To figure out the right answer you have to understand what leverage is and what it does to your portfolio.

What is Leverage?

Leverage is a tool that allows a real estate investor to acquire many times the asset value than they otherwise could if they paid cash. For instance, if an investor had $100k in capital they could purchase one $100K property if they paid cash or purchase $500k worth of property if they put 20% down on each. Why does this matter? It matters because in the event that each of the portfolios experiences 5% appreciation in value, that translates to $5,000 increase for the cash investor and $25,000 increase for the leverage portfolio. In other words, by increasing the asset value in the portfolio five fold, you increase the return on that portfolio five fold as well.

That’s the good aspect of leverage. Leverage also adds significant risk to your portfolio. The investor that owns one $100k property outright may not experience tremendous growth when things are going well. But on the flip side, if the market isn’t doing well, that investor could weather the storm better because they don’t have to make mortgage payments. Also, if property values are declining instead, leverage multiplies the value loss five fold as well. So leverage is definitely a double edged sword.

Two Options

Back to our fork in the road. If you decide to turn left, purchase more properties to increase your positive cash flow until you reach a point that your income exceeds your expenses, you are opting for perpetual leverage. In other words, you are constructing a portfolio with more cash flow, more debt and more risk. By opting for cash flow now, you are conceding that your portfolio will be encumbered by debt perpetually. And yes, I’m aware that it is a 30 year mortgage but let’s not kid ourselves, those properties will be traded for yet another debt encumbered property long before the 30 year mark. If instead you turn right, utilize the current cash flow to fuel and accelerate the debt payoff on your portfolio, you are using smart leverage. In other words, you are using leverage as a tool to get you from $500k in debt encumbered asset value to $500k in paid off properties in a short period of time therefore reducing the inherent risk that comes with it.

Answer

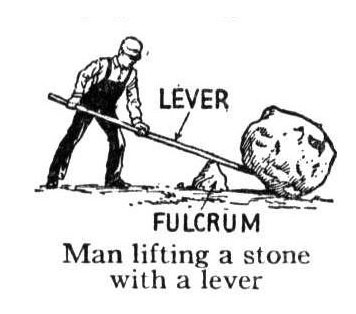

The ultimate answer depends on your investing philosophy. If you have a high tolerance for risk as long as it comes with higher returns then you opt for perpetual leverage. Instead, if you are conservative and like to take calculated risks for solid predictable returns you choose smart leverage. However, if you are building a real estate portfolio for retirement, there can only be one right answer: Smart Leverage. For two reasons. First, even the best “lever” can snap if used in perpetuity. And most importantly, can you imagine retiring using a portfolio with enough cash flow but millions of dollars in debt? There isn’t a sleeping pill strong enough.

—

Even better, why wait until you get to that fork in the road? Let’s talk beforehand so we can lay out a Blueprint strategy on purpose so you know the path to follow. My cell is 713.922.2702. Have a great weekend!