In the word of long term real estate investing, cashflow is the holy grail. Everyone wants it, searches for it and wants to know how to get it. And who can blame them? Build enough positive cashflow without undertaking excessive risk and you’ve made it. Free to do whatever you wish with your life without worrying about that monthly overhead “anchor” that keeps you tied down for decades. But most real estate investors have a mathematical understanding of what cashflow is but not a conceptual one. They see cashflow as the difference between incoming rent and expenses. That definition is correct – but it doesn’t explain what cashflow is at its very essence. And in the end, that essence makes the difference between a strategy that achieves your goal and one that falls short.

In a nutshell, positive cashflow is the yield on capital – similar to the interest you earn on your CD without the sorry rate. The more money you put in, the more interest you get out. Generally speaking, interest rates paid on CDs of the same term are about the same. So the only way for you to get more interest is to invest a higher amount of capital upfront. Paid off real estate tends to behave in much the same way. If you were to purchase a property in a suburb of Houston for $140k in cash, it would produce approximately $11,000 in positive cashflow – 0r about an 8% yield. Want to make 10 times more money? You better figure out a way to grow your capital – or equity ten fold.

It seems like I’m suggesting you need to have large sums of money to invest to be successful in long term real estate investing, but I’m not. What I’m suggesting here is that if you seek cashflow, your first and only priority going forward should be to grow your capital base. For example, say you have $100k to invest. Even by leveraging your capital, acquiring three properties with 20% down and creating a 12-13% return you’re looking at an annual income of $13,000. Better than a poke in the eye but certainly not retirement money. If your goal is to increase that to triple the size, you have to figure out how to turn that $100k into $400k between now and the time you retire. And you can do that by utilizing your cashflows and your job income. That’s the magic. The leveraged cashflow you create when you acquire your properties is just the tool you use (in conjunction with your income) to increase your capital base/net worth/wealth. So that when time comes to draw yield from that capital base, it’s big enough to provide sufficient income for you to retire. Subscribers to the perpetual leverage method will disagree with me on this but they’re wrong. Creating your cashflow by purchasing and accumulating 4x to 5x the number of assets involves increasing your risk ten fold. And having a portfolio with a boatload of homes leveraged up the nose for thirty years isn’t retirement – it’s an open invitation for Murphy to become your roommate.

The way to an annual investment income that sets your free goes through “Build your Wealth First” city. Any shortcut and you won’t reach a place worth going.

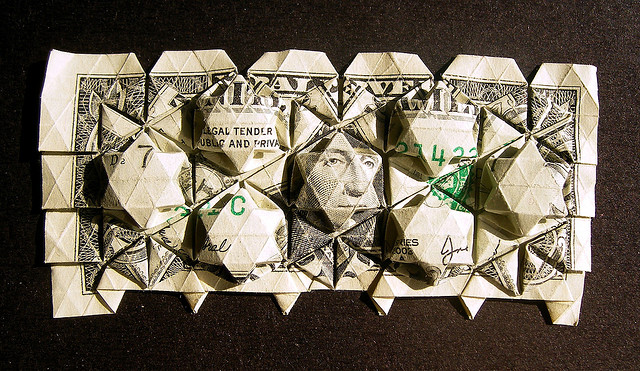

Eric Gjerde via Compfight