Despite historically low interest rates, real estate investors are struggling to find investment properties that produce positive cash flow in today’s real estate market.

On one hand, real estate markets across the country have been soaring fueled by high demand and low supply. Rents have also risen but not at the same pace as prices which has put downward pressure on cash flow.

On the other hand, property taxes and insurance costs keep rising every year as municipalities and insurance companies try to keep up with increases in value. As a result, investing in single family properties has become less and less profitable especially if you want to have the property professionally managed.

In the Houston market, most single family investments in high quality locations are heading toward breakeven territory… fast. That means the property pays for itself but does not produce any additional income.

So what can real estate investors do to accomplish their investment goals in this environment?

What if I told you that there’s an opportunity to purchase new construction luxury duplexes in a fast growing market that produce positive cashflow while being professionally managed for a true turnkey investment?

Summary of Project

Dobbin Meadows is a Class-A new construction multi-family project in Magnolia TX (just 3 miles west Woodlands Parkway). The project is built by Value Builders Inc – a high quality builder that has developed similar communities in all major metroplexes in Texas: Austin, DFW, San Antonio and Houston. Value Builders has a 65-70% repeat client rate which means 65-70% of duplexes they build are purchased by investors who have purchased previously in other Value Builder communities.

Phase 1 of the project will consist of 39 duplexes – the first 30 of which were sold before construction began. Dobbin Meadows is located in Magnolia Texas in Montgomery county and it is zoned to Magnolia ISD schools. It is part of a DR Horton community called The Enclave at Dobbin. The Exxon Mobil campus and soon-to-be Hewlett Packard headquarters are a short 20 minute drive away. Within a short drive, residents can take advantage of world class hospitals, retail and dining in the Woodlands.

The Magnolia area has experienced tremendous population growth over the last 10 years growing by over 50% during that time. In addition, the Houston area ranks second in the nation for corporate relocations (incoming) and expansion projects which means the area benefits from strong Tenant demand and solid rental market.

One unique feature of this project is that these duplexes are built as attached townhomes which offers the special opportunity to sell each side individually in the future thus increasing the total exit price. And you can do all this while still obtaining just one loan to acquire both units like a duplex. In prior projects, this feature has enabled the investors that purchased them to sell each side for close to what they paid for both units just 5-7 years later!

Photos of Finishes

Investment duplexes in Dobbin Meadows are currently under construction with the first 3 duplexes to be completed in mid September. The photos below are from a previous community Value Builders built in Conroe in 2018-19 to show the quality of finishes and layout of the space.

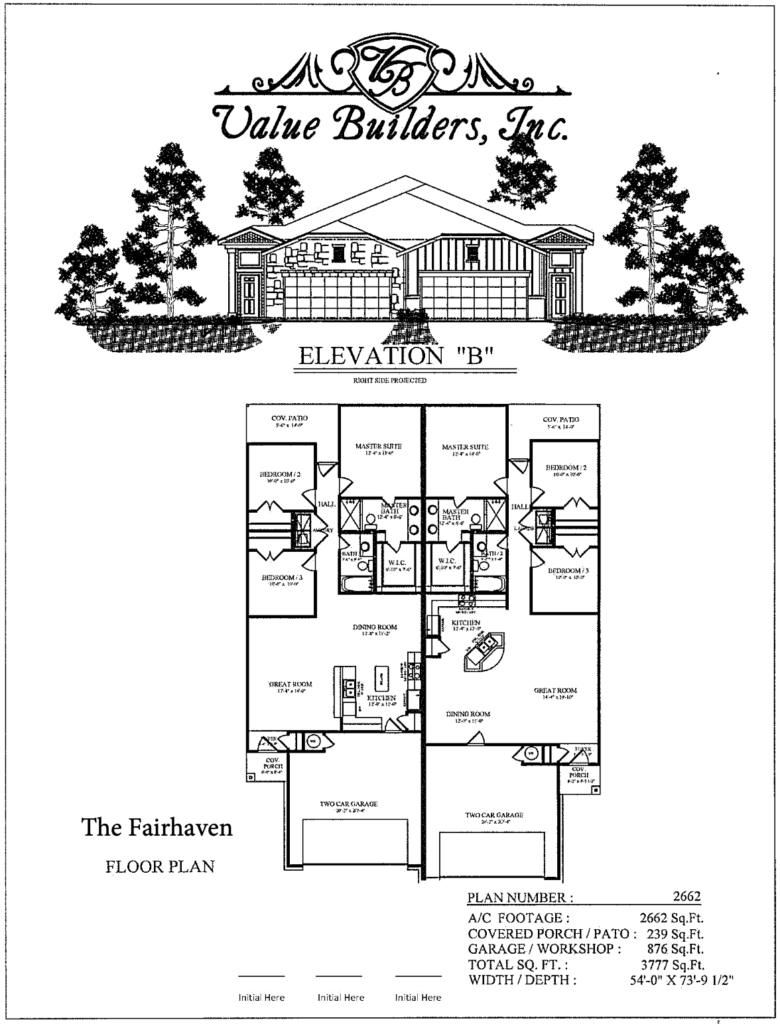

Floorplans and Sizes

The Builder is offering their top 2 selling and leasing duplex floor plans in this project

- The Fairhaven is a 1-story 2662 sf, 3 bedroom 2 bath 2 car garage on each side, brick/stone and Hardiplank exterior

- The Asheville is a 2-story 2930 sf, 3 bedroom 2.5 bath 2 car garage on each side, brick/stone and Hardiplank exterior

Note: The remaining 10 lots are all Fairhaven plans which is their most popular and proven floorplan.

Both will have fenced-in backyards, premium LVT flooring throughout the first floor and the bathrooms, granite counters in kitchen, stainless appliances.

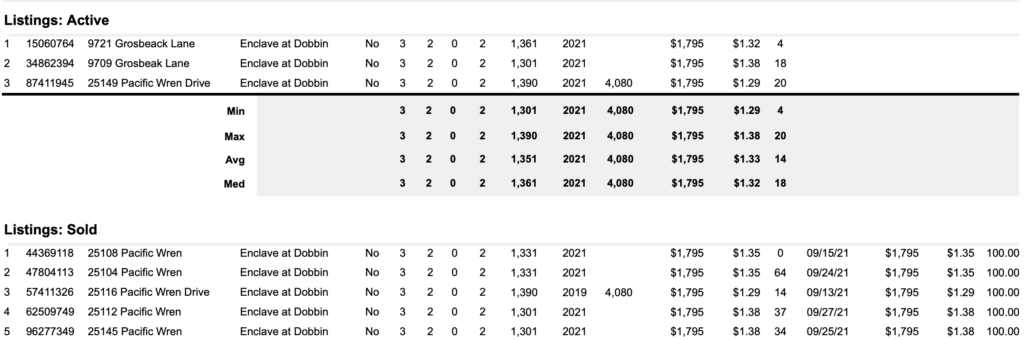

Rents and Leasing Activity

Rents for the 2662 Fairhaven floor plan are projected to be $1750 and $1795 per month.

Leasing has already begun and several units have been leased at $1795 per month so you don’t have to rely on just pro forma rents. Below is a current market analysis for rent that shows leasing activity in the community. As I mentioned earlier, this leasing activity is before the luxury duplexes are completed.

Rent Roll

Below is a schedule of projected rents for the Duplex for sale Texas at Dobbin Meadows. These rents are based upon prior projects the builder has completed in the immediate area, the expertise of the property manager who knows the rental market exceptionally well as well as actual leasing activity (see above).

| Bed/Ba/Ga | Square Footage | Monthly Rent | Rent/SF | Annual Rent | |

| 3/2/1 | 1301 | $ 1,750.00 | $ 1.27 | $ 21,000.00 | |

| 3/2/1 | 1361 | $ 1,795.00 | $ 1.31 | $ 21,540.00 | |

| 2,662.00 | $ 3,545.00 | $ 42,540.00 |

Cashflow Analysis

Below is a projected cash flow analysis for new construction duplexes at Dobbin Meadows

| Dobbin Meadows Plan 2662 Duplex | |

| 6 Bedrooms 4 Baths | Year Built: 2022 |

| School District: Magnolia ISD | Size: 2662 SF |

| Property Type: Duplex | Market: Houston |

| Price/SF: $ 178.44 | Rent/SF: $ 1.33 |

| Asking Price | $475,000.00 |

| Market Value | $475,000.00 |

| Purchase Price | $475,000.00 |

| Down Payment | $118,750.00 |

| Initial Repairs | $0.00 |

| Closing Costs | $7,125.00 |

| Investment Capital | $125,875.00 |

| monthly | |

| Projected Rent | $3,545.00 |

| Vacancy | $106.35 |

| Property Taxes | $1,100.22 |

| Insurance | $66.67 |

| HOA Fee | $58.33 |

| Maintenance and Repairs | $34.39 |

| Property Management | $171.93 |

| Leasing Fee | $88.63 |

| Landlord-Paid Utilities | $0.00 |

| Total Operating Expenses | $1,626.51 |

| Net Operating Income | $1,918.49 |

| Mortgage Payment @ 3.5% – 25% Down | $1,599.72 |

| Monthly Cashflow | $318.77 |

| Principal Paydown | $568.88 |

| Appreciation Return | $1,880.21 |

| Annual Depreciation Deduction | $13,822.50 |

| Total Monthly Return | $2,767.86 |

| 10-Year Annual Rate of Return | 15.72% |

Bonus Cashflow for the first 2+ years

The cashflow analysis above looks at how the property will cash flow once property taxes reach full maturity. However, when you purchase new construction it typically takes 2-3 years before property taxes reach full maturity. As an illustration, here’s the tax assessment summary for a duplex built in 2019

As you can see, this duplex began construction in 2018 where it was assessed at the value of raw land. Then in 2019 the property got assessed at land valuation because the property was not built at the beginning of the year. Even in 2020, when the building value got added in, it’s still at $213,560 on a duplex that sold for more than $430,000.

This is just an illustration, but it’s meant to show that it takes the tax authorities 2-3 years before the tax valuation reaches full maturity. What that means to you as an investor, is that during those 2-3 years the property will produce much more bonus cash-flow for you.

Last 10 Lots Just Released

Value Builders has just released the last 10 lots in Phase 1 for purchase. Expected completion on these lots is April 30, 2022.

Here’s the latest availability plat map. The last 10 lots are on Grossbeak Ln within the blue box. Five lots have already gone under contract and two available lots are reserved for an all-cash purchase only. The available lots are the ones with the green dot.

Next Steps

Based on the number of calls I’m holding daily with investors, I don’t expect these remaining available duplexes to last for more than 10-14 days. In order to put a duplex under contract, you will need a pre-approval letter (financed) or proof of funds (cash) and the lot you want to select. Then once the contract is signed, the earnest money is $5000 per duplex. If you are interested, give me a call at 713-922-2702 and let’s talk.

Leave a Reply