Fact: Every investor I’ve had the privilege to help has worked extremely hard to earn and save the capital required to make long term real estate investments. So it’s no wonder that as an investor you want to put in practice strategies that maximize your return on that capital. But I have a slightly different take on this matter. Because I’ve seen first hand how hard many of you work to create that capital, we have a duty to make that capital work as hard as possible to help achieve your financial goals.

So in that vein, today I want to introduce the concept of velocity of money and show you a strategy to increase the velocity of money your real estate investments produce and turbocharge your returns in the process. First of all, the concept of velocity of money can mean very different things depending on the context (i.e macro economic or field specific). For the purposes of this article we are looking at velocity of money strictly as it applies to long term real estate investments.

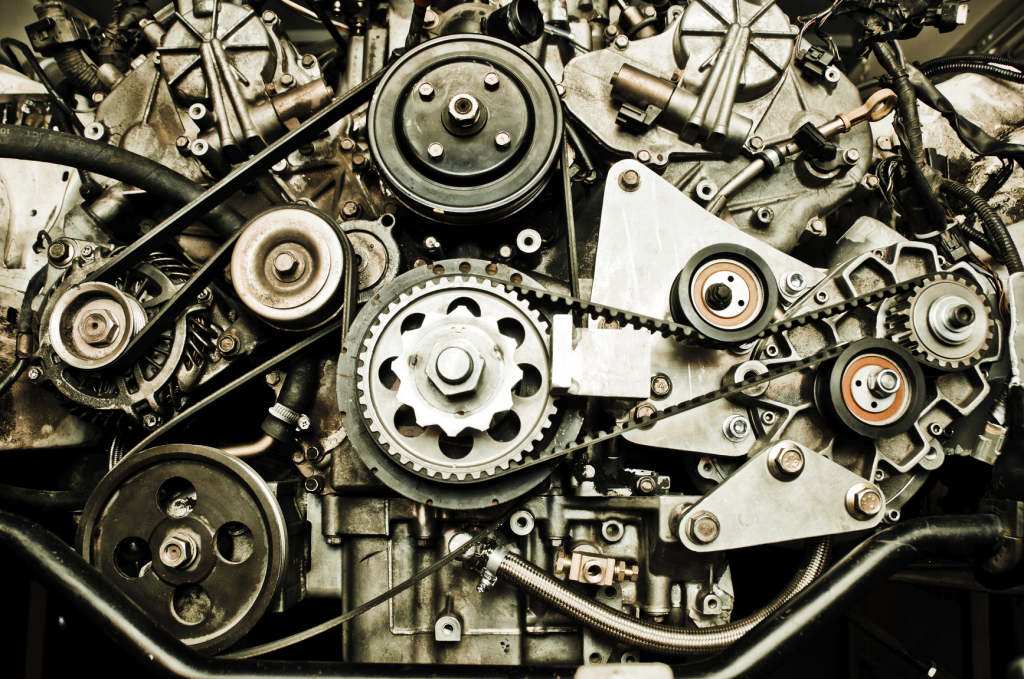

In simple terms, consider the following analogy to illustrate velocity of money at work. Imagine that an investment property is an actual vehicle and the initial capital to acquire that property is the fuel for that vehicle. When you put your capital to work in a long term investment property, it produces positive cashflow that represents a return on that capital. In our illustration, when you put “fuel” in your “vehicle” and engage the first gear, it will reach a certain speed or velocity. But now that you receive the return on your initial investment you come to an important fork in the road. You could spend the positive cashflow on regular expenses or leisure (as it’s your right) or you could put the cashflow back to work to earn even more. In our analogy, this would be the equivalent of “staying on first” or engaging the second gear and making the vehicle go even faster. That’s velocity of money in a nutshell: When you re-invest the earnings of your capital to earn even more, the overall return on your original capital increases significantly. Compound interest – a much more familiar concept – is essentially velocity of money at work.

Two strategies to increase velocity of money

In long term real estate investing there are two principal methods to turbocharge investment returns by increasing the velocity of money.

The first method involves using the positive cashflow produced from your initial capital to pay off existing debt. In this scenario, the added return on your positive cashflow is the interest cost saved by paying down the principal on the mortgage. Let’s take a look at a concrete example.

Suppose you acquire an investment property for $160,000 with a down payment of $32,000 (20%) and closing costs of $3,000 for a total initial investment of $35,000. For the remaining balance you take a 30 year fixed rate mortgage at 4.75%. At the end of the year, the property produces $4,500 in positive cashflow after all expenses and mortgage payments, which represents a 12.9% cash on cash return. If you take the positive cashflow and re-employ it to accelerate the payoff on the mortgage on your investment property, that results in interest cost savings of $214 per year bringing your total return on your initial $35,000 to $4,714 which represents a 13.5% cash on cash return.

The above example is the reason why I burst out laughing when critics of the Domino strategy brand it as “paying off low interest debt with high return dollars”. You see, when you accelerate the payoff on debt, you’re not substituting high return dollars for paid off low interest debt. You are increasing the return of those high return dollars even further instead of stashing them away in a bank account paying 0.00017% interest or worse, spending it.

The second method to increase the velocity of money in your real estate investments is to recycle the positive cashflow produced by your properties into acquisition capital (down payment) for additional properties to acquire according to your Blueprint.

Let’s resume the example where we left off. Suppose that a year after you acquired the first investment property above, you want to acquire another, identical property that requires $35,000 in initial capital. But this time, instead of coming up with the entire amount from your savings, you use the $4500 in positive cashflow from your first acquisition and make up the difference from your savings. In this scenario, the $4,500 cashflow that produced a 12.9% return on your original $35,000 capital is earning 12.9% when invested in the second property. That’s another $581 return on the original capital which increases the cash on cash return to 14.5%.

Here’s the real kicker: So far, we’ve spoken only about increasing cash on cash returns. What happens when the property increases in value and you are leveraging your positive cashflow further to earn additional double digit returns? Don’t answer that.

Which method should you choose?

By now you must be thinking to yourself: Recycling cashflow into acquisition capital seems to be the no-brainer method of choice among the two. But there’s one crucial ingredient missing in that “stew” of thought: Risk. I know it’s not as much fun to discuss risk as it is returns. But this pesky socialite attends every party real estate investments attend. So we must account for risk at the outset or pay for it from our checkbook. The first method of increasing returns by paying off debt seems understated in its added return but what it does offer in addition is risk reduction. Everytime you get a step closer to a paid off investment property, you are shaving off a chunk of risk from your porfolio. That’s why the increase in returns is smaller. When you recycle the cashflow into acquisition capital, it will earn a higher added return but it involves the acquisition of another asset. In addition to the return it produces, it increases risk as well.

So what should you do – which method should you pick? As with all good questions, the answer is “it depends”.

One factor to determine which method is the best for you is whether or not the investor has the savings capacity from her income to save all the capital required to make all the acquisitions per her Blueprint. If the answer is yes, then the investor is better off working both sides in parallel. In other words, she can use the cashflow to accelerate the payoff on her debt and use her savings capacity to complete her acquisitions. If the answer is no, then you’d be better off putting aside debt acceleration for a short while and employ all cashflow and savings to complete your acquisitions – then resume the Domino strategy once your portfolio is complete.

But – you might say – that may seem counterintuitive. Even if you have the money to complete acquisitions from your savings, why wouldn’t you use the cashflow since that yields the highest added return? The reason is simple: Our ultimate goal as long term real estate investors, isn’t to get the highest return on investment but rather to reach our income stream goal through a paid off real estate portfolio within the allotted investment timeframe.

Therefore, the true question isn’t whether you pay off debt to increase velocity of money but rather when to pay off debt. Depending on your level of risk aversion, available time to reach your goals and your overall preference you may decide to start the debt payoff right away or once your acquisitions are complete. But start it you must if you are to achieve the level of income you seek at retirement.

In conclusion, your money has to work at the very least as hard as you do and ideally multiple times harder. The way to achieve the highest possible return from your investment capital without adding reckless levels of risk is to increase the velocity of money by re-employing positive cashflow to earn at its maximum potential.

—

For more on velocity of money and how to think and invest like a banker, I strongly recommend the book “The Bankers Code” by George Antone. It was recommended to me by a good friend and it’s a very powerful book.