Today’s post is exciting for me to write primarily because of what it can do for investors that actually heed the advice.

Since the beginning of Investing Architect, I’ve argued that quality real estate purchased in the context of and according to a sound overarching long term strategy can alter an investor’s life in fundamental ways. Surely, it can have an impact in that investors financial life – namely her passive income and net worth. But that’s only part of the magic. Most importantly, through their financial impact they can offer what I believe most of us are truly after: The freedom and independence to craft a life well lived.

I have a Freedom Formula that I’d like to share with you:

(Quality real estate + Strategy+ Discipline + Execution)^ Time = Freedom

The case study I’ll go over with you today is the “proof” of the validity of this formula. Let’s dive in the numbers.

Case Study

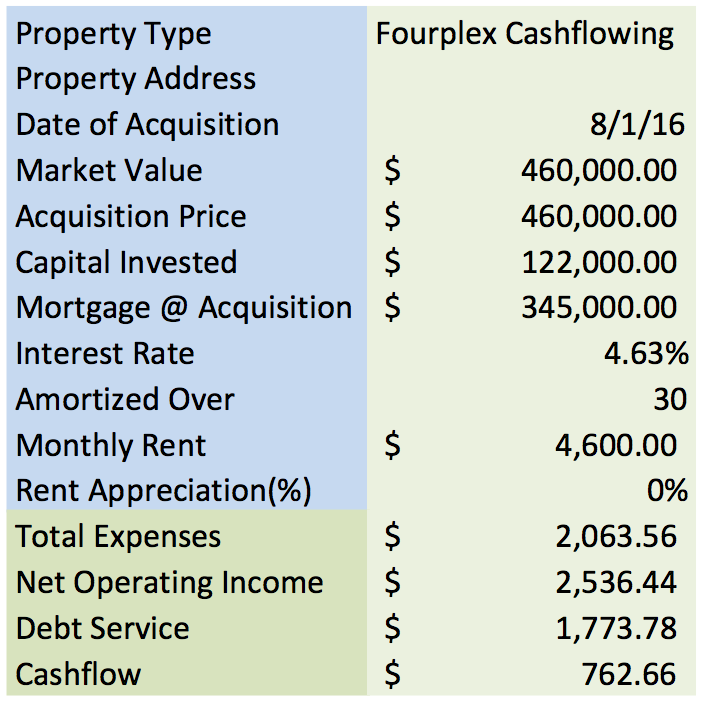

Suppose you were presented with an opportunity to invest in brand new small multifamily (4 units) properties in a new development in an established Texas market with impressive population growth and solid tenant demand with strong median household incomes to support your rents.

Annual Income: $55,200 (4 units leased at $1,150 per month)

Total Operating Expenses: $22,563 (property taxes, insurance, management and repair reserves, vacancy provision)

Net Operating Income: $32,638 per year

Debt Service and Leasing Fees: $23,485 per year

Positive Cashflow: $9,152.64

Purchase price: $460,000

Cash to close: $122,000 (25% down payment plus closing costs)

Why Strategy matters

This is usually the point where first time readers get a puzzled look on their faces. “Wait a minute – how do we go from a potential investment property that throws off $9,200 a year in positive cashflow to turning $244,000 into 1.4 Million?”.

In one word: Strategy.

There’s a reason why strategy is the second ingredient of the formula. Quality real estate comes first because in it’s absence none of the remaining factors matter. You could have the most sophisticated strategy in the world, the discipline of a buddhist monk, and Jason Bourne’s execution skills and none of it matters. But once you’ve purchased quality real estate your strategy makes the difference between magic and meh. Every month I meet with investors that through sheer gut feel have acquired a couple of quality properties. But only minutes into our conversation it becomes abundantly clear that their investing efforts lack a general direction, an overarching strategy. Therefore, they do okay with their investment but they leave massive potential on the table.

Let’s get back to the numbers to illustrate the opportunity cost of a solid strategy. If you were to purchase this same exact property but lacked a long term strategy, what would happen? Well, you would be earning 7-8% on your money (conservatively) and would take advantage of leverage as the property appreciated over time. That’s not a bad investment but it doesn’t exactly change your life.

Here’s a better option. For the investor with available capital resources, I’d recommend the purchase of two fourplexes (8 rental units in total). The completion of these two transactions requires $244k in capital (+- 1%). Upon the completion of acquisition, I would have this investor utilize the positive cashflow from both properties to aggressively pay off the mortgage on the first property while making regular payments on the second. To add more “wood to the fire”, I would recommend that the investor contribute an additional $500 from her income to accelerate debt retirement even faster. Think of this as a 401(K) contribution that actually works.

What’s the effect of this strategy? The mortgage on the first property is completely paid off in 112 months (just over 9 years). After the first property is free and clear, the positive cashflow from that property is no longer $9200 but rather the entire Net Operating Income of $32.6k since there no more debt to service. Now I’d recommend that the investor continue the same process with the second property. The only difference is now we’re attacking that mortgage with a LOT more money every month. Therefore the mortgage on the second property is paid off in 57 months (just under 5 years.

Final Results

Let’s look at the only thing that ultimately matters: Results. If you heed my advice, you invest $244,000 of your hard earned capital and after applying a Domino Strategy you end up with two free and clear properties in 14 years that assuming an appreciation rate of 3% (inflation) would be worth $1.395M at that time. Also at that time, these two properties would produce $65,000/year in investment income. That’s the difference between just buying a couple of good properties and buying a couple of good properties according to a solid strategy mixed with discipline and laser focused execution raised to the power of time.

—

Important Note: A project with 11 new construction 4plex and 4 new construction 6plex multi family properties in a growing Texas market is about to break ground in 2-3 weeks. We have partnered with the Developer to offer first shot on these properties to our clients during the construction phase. Over the next few weeks, we will be holding one-on-one conference calls with our clients to discuss the opportunity. Typically we sell out projects of this magnitude in 2-4 weeks.

If you are interested and would like to receive an information packet containing detailed cashflow analyses, location map, site map, demographic and psychographic data about the location, contact us or if you’re reading this from your email, just hit reply.

Pingback: Friday Fab Five - Freedom Formula, Online Rent Payments, Biographies, & More - Coach Carson

This hurt so much to read. 14 years? TWO properties over 9 years? Ouch! I can turn that same $200+k into 1.4 million in a LOT less time. Leverage is what makes money. These properties should be obtained with as little out of pocket cash as possible. Wholesaling, and sub2 can have you owning multiple properties and building up cash reserves in a fraction of the time you mentioned here.

Brandon

Thanks for your comment but I wholeheartedly disagree. Leverage is a sword that cuts both ways – essentially amplifying the solidity or weaknesses of an investor’s strategy. When employed properly, it can work wonders. When employed irresponsibly as you suggested, it’s the fastest highway to bankruptcy court.

In the end, I have a bad habit of following the money when I evaluate investment strategies. Here’s what I mean: If wholesaling or subject2 are such lucrative strategies where are the real estate moguls that built their wealth through them?

I know I likely won’t change your mind but real estate as an asset class performs at its very best when it possesses certain qualities of location and finishes and it’s put to work over the long term. The rest are gimmick strategies to sell to newbies in the latest “Secret system they don’t want you to know about” for just $997. 🙂

I agree. Subject 2/wrap-around mortgages are gimmicky and dangerous. Excessive leverage will kill you. Anyone remember what happened to all those 0% financed rentals when the market turned down and those razor thin cash flow margins went negative?

I am living proof that Erions strategies work. I stumbled upon them myself through trial and error. I started in 2001 with a net worth of near zero and after investing around $257K over the years from my job as a professional I retired in 2015 with a net worth now of $1.8MM. If I had followed this strategy from the start I would have gotten here a lot sooner.

I’m doing something similar but with less capital. I bought 2 SFR rentals. When I compare my 1 door to your 4plex the numbers are similar, but at 25% scale. I’ll get back to you in 14 years and let you know how it goes!

Travis

The formula works with single family or small multifamily. Like you said, it’s just a matter of scale. If your income goals are high, it’s hard to accomplish them with single family homes without turning into a de-facto property manager.

Love to hear success stories so please keep me in the loop

Erion, your numbers assume full-time property management by the owner, correct? What are the tax implications? To what extent is the income and asset appreciation still possible after taxes? Thanks

Erion,

Found your site through BiggerPockets. I dig your writing style– very refreshing to read actual content rather than just fluff (which BP doesn’t have much of, but I’m speaking to articles in general).

My strategy is to acquire as many buy-and-hold rentals as possible. I am not as concerned about net worth, but rather cash flow.

I think something you gloss over a bit is saving up that $245K as the down payment. Many people have to start on a smaller scale… and IMO it is better for them to start on a small scale with a $100K property and 25% down then wait and sit on cash while it’s taking forever to accumulate. But I will say I am fortunate that I live in a LCOL market, so those $100K properties are pretty easy to find. I just wanted to caution you to not make it sound too flippant- the part about saving up the down payment as you could possibly alienate readers.

I’m with you that rentals are the way to go. Put your money to work and let your tenants build your equity for you. And then laugh all the way to the bank. That’s my strategy at least!

Pingback: An Early Retirement Blueprint With Erion Shehaj (Ep 101 - Show Notes) - Coach Carson

Pingback: How to Adjust Your Financial Independence Plans as the Market Changes - Coach Carson

Erion, great article, but you forgot one thing: you have to add up the additional $500/month the investor is also putting into these properties as well each month. So it isn’t just the down payment that is cash out of pocket for these properties, it is also that $500/month payment. Thx

Pingback: Riqueza – Consciente – Inversiones – Bienes Raíces - Pueblo Consciente

Pingback: #293: Four Reasons to Pay off Debt on your Rental Properties – Demo

Pingback: 4 Reasons to Pay Off Debt on Your Rental Properties » ImDebtFree.com