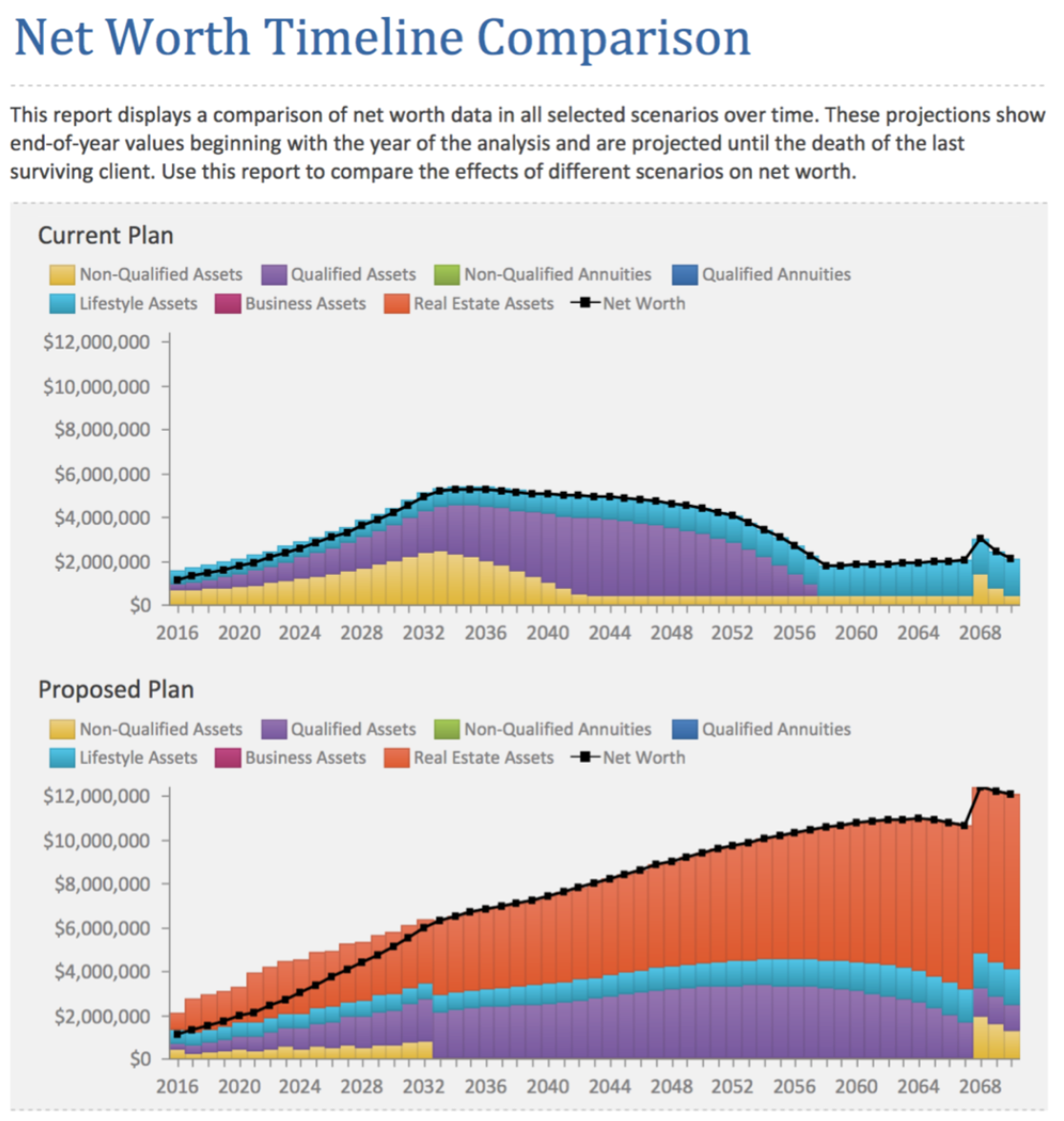

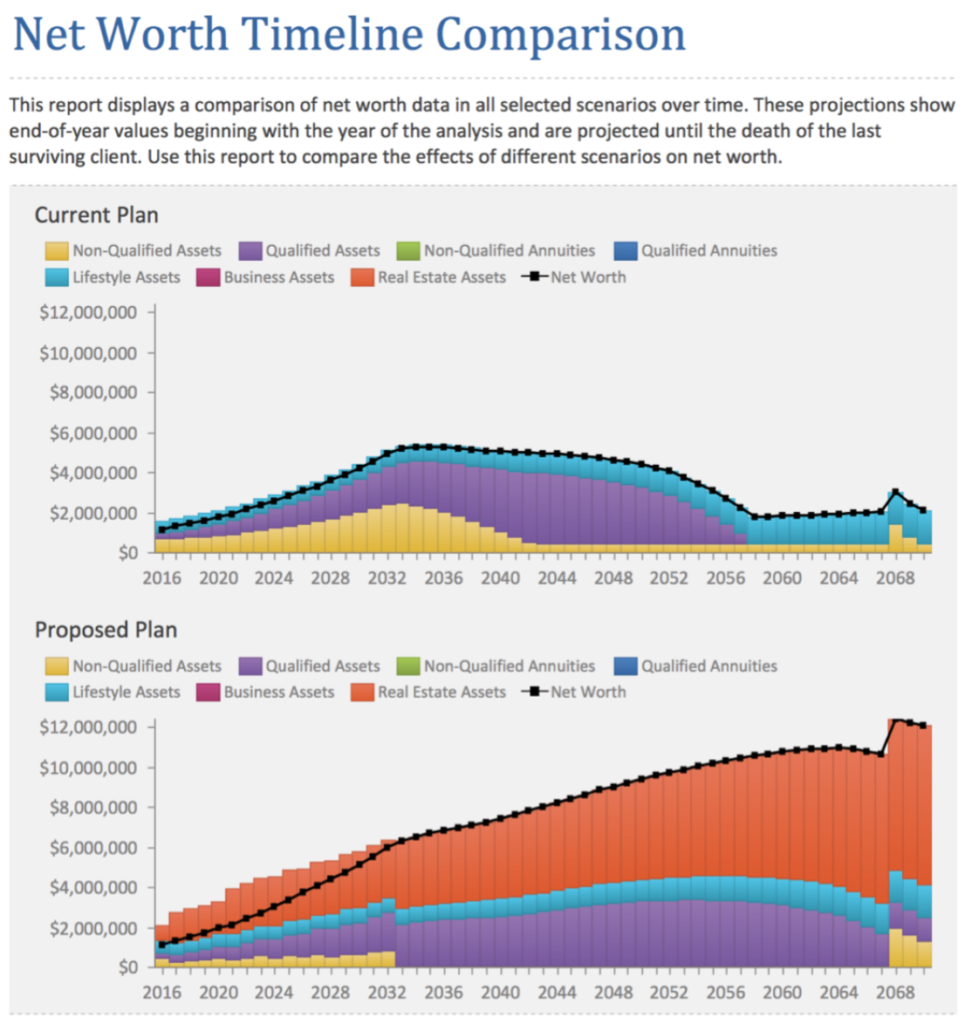

Take a good hard look at the Net Worth Timeline Comparison graph below:

It’s a colorful, damning indictment of the Nest Egg approach to retirement that an overwhelming majority of investors in the developed world follow.

Let me set the scene for you so the meaning of the graph can come into better focus: A very disciplined high net worth individual (over $1MM) with a six figure job income maxes out contributions to tax advantaged retirement accounts (401k) and college savings accounts. Her family lives well below their means so even after those contributions there is surplus income that is invested regularly in a taxable stock/mutual fund account (dollar cost averaging).

The return assumptions are the same shade of conservative we use on real estate investment projections. We are assuming that all accounts will average a 6% linear return annually and that stock markets don’t shed 40-50% of their value every 8-10 years. In addition, we’re also assuming that the surplus is invested without fail (continued discipline) in brokerage accounts. Finally, on the real estate side, we assume that property values track inflation (3% per year) and base income and expense projections on actual figures.

The first graph at the top illustrates the investor’s net worth projection should she follow the current investing path (securities) projected out over the next 50 or so years.

The second graph at the bottom illustrates the investor’s net worth projection if she followed our Blueprint strategy. Under the Blueprint strategy, she would utilize current investable capital plus a portion of the income surplus (60%) over the years to acquire and pay off quality income-producing real estate assets. That leaves the remainder of the surplus to fund major purchases, travel etc. As she executes on her real estate investments she would continue to max out tax-advantaged accounts and invest those funds in securities for an all-of-the-above approach to investing.

Two critical junctures

Let’s take a look at two points in time – The first is the projected retirement date in 2033 (at the age of 55). On that date, the projected net worth under the Blueprint Plan is $1MM (22%) higher than under the current path ($6.2MM vs $5.1MM). But that’s where these paths only begin to go in two opposite directions.

During the retirement years until the end of the plan (life expectancy 90), under the current path the investor’s net worth drops by 60% (to $2MM) while on the Blueprint Plan the investor’s net worth increases by 70% (to $10.6MM).

What happened here? Why such vast difference in the two approaches in the years following retirement? The answer: The differences originate in the structure and basic concept of the two strategies.

The Nest Egg Approach

By definition, the Nest Egg approach retirement investing has two phases: Asset Accumulation and Asset Distribution. In other words, during your productive years you are to set aside and invest a portion of your disposable income so you can accumulate assets. Then following retirement, you will distribute (read: plunder) a sizable portion of those assets to fund your income needs during retirement. In fact, on tax advantaged accounts such distributions are mandatory.

Therefore it should come as no surprise that the investor’s net worth dropped by 60% during retirement years. That was the plan all along!

Now – you might ask – what’s wrong with a plan where you save for retirement, arrive there with $5MM in net worth and leave $2MM to your heirs when you are gone? It’s not that it’s wrong – it’s just that you could do so much better!

If the legacy you leave behind for your loved ones is important to you, why not explore a different path that leads to better income at retirement while allowing your net worth to rise instead of plummet?

The Blueprint Approach

The approach I’m suggesting is fundamentally different. I don’t believe that the optimal path to retirement is to accumulate assets so then you could live off of them in retirement. Instead, I would advise you to accumulate cash flowing real estate assets and pay them off over time so the income they create takes care of your retirement lifestyle while the principal (net worth) is untouched and rising. Live off the yield and don’t cannibalize the principal.

The results speak for themselves. If by using the same resources (capital, income, time) you can end up with a net worth that’s 20% higher at retirement and 5x higher at the end of your plan, why wouldn’t you?