There’s lies, damned lies and statistics. With all the misinformation and spin that surrounds every release of statistical real estate data, it can be hard to tell how the real estate market is really doing. But every long term real estate investor needs to have a good understanding of where the market is at any point in time since this deeply impacts the decisions and choices she makes going forward.

Case and point: Is the Houston real estate market currently in a real expansion or is what you’ve been hearing more fluff from cheer leading real estate agents? The latest reports on real estate sales in the area show both prices and sales going up double digits year over year. But I also remember reading articles on how well the real estate market in Houston was doing right in the middle of 24 months of declining sales. Sure, we did a hell of a lot better than most other parts of the country but in the kingdom of the blind, the king has one eye.

So if you can’t trust the data interpretation, how can you tell how the market is really doing? I’ll tell you about a proven indicator that you can see for yourself today. Time for a mini road trip. Hop in your car, drive to a new home subdivision after lunchtime, and listen. Do you hear the sound of nail guns and hammers? Are construction workers framing up spec home after spec home? If it’s silence you hear, the market may be recovering from a recession but it’s not expanding yet.

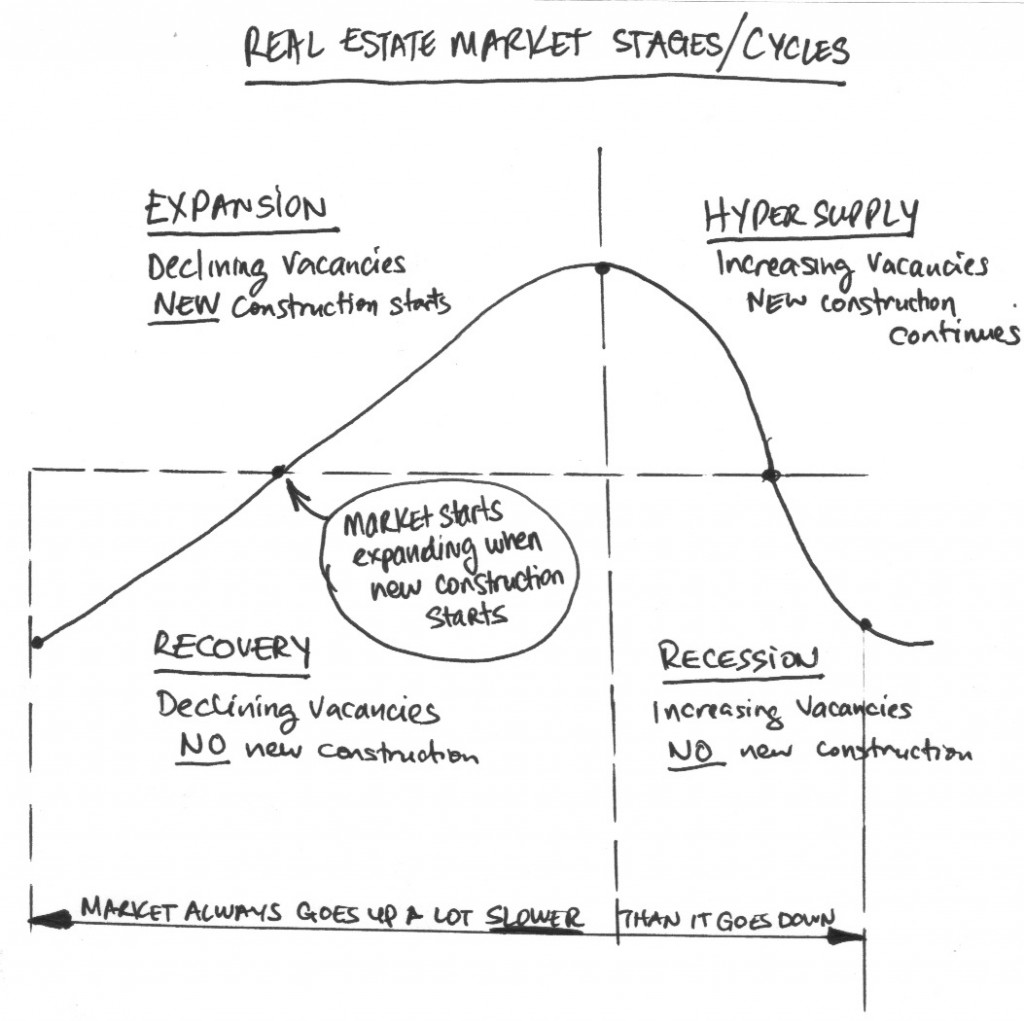

Take a look at the four real estate market cycles graph below. It describes the Recession, Recovery, Expansion and Hypersupply stages that commercial real estate goes through but the principles hold true for residential real estate as well.

Remember this: There’s no expansion without new construction. Builders don’t start building again until they see real demand pick up. Take that one further: Drive around the Galleria or Midtown or Downtown? Do you see cranes? Are developers building more office buildings and luxury apartment complexes? Imagine the level of investment that Gables puts into building a new 600 unit luxury apartment complex. How much do you think they paid for that land in the Galleria? They have to know with reasonable certainty that demand for their units will be there when they’re complete or they don’t pull the trigger on the project.

That drive through Houston’s city centers or new construction subdivisions today will tell you that the real estate market in Houston has truly turned the corner. And you don’t have to take my word for it. You can see for yourself.

Photo Credit: José Manuel Ríos Valiente via Compfight

This is a good point to bring up … being able to evaluate at what “stage” or cycle the real estate market is currently in.

Some swear by the numbers (which I seem consistently trying to narrow-down my sources for…) while others choose to witness and judge with their eyes.

As a follow-up to this post, I remember recently reading somewhere about a simple metric to follow when determining periods which to use caution. It stated that as property prices expand more than 20% past their respective cost-to-build, then it pretty much begins to signal that a turn is approaching.

*Although I’d like to hear others input on this issue.

Thanks Clay.

“Some swear by the numbers (which I seem consistently trying to narrow-down my sources for…) while others choose to witness and judge with their eyes.”

Enron was proof that you can make numbers say anything. But even when accurate, you can always see people have diametrically opposite reactions to the same set of numbers picking and choosing the statistics that fit their narrative. I believe we should always look at the numbers but never forget to employ our common sense and our observations.

“As a follow-up to this post, I remember recently reading somewhere about a simple metric to follow when determining periods which to use caution. It stated that as property prices expand more than 20% past their respective cost-to-build, then it pretty much begins to signal that a turn is approaching.”

That makes a lot of sense. In fact, one of the reasons why so many investors flocked to Houston is due to the fact that much of our properties in the suburbs was being sold at below construction costs so it was only a matter of time before it stabilized.

Thanks for the comment.

Erion