Today I want to tell you about one of the biggest myths in real estate investing. It is the disempowering belief that people who succeed in building substantial portfolios and reaching financial independence early do so because they hit a financial “home run”. Usually, it involves some type of windfall event like an inheritance, large bonus, help from rich parents or lottery winnings.

The reality I have experienced firsthand is the exact opposite. With rare exceptions, the overwhelming majority of real estate investors that have reached financial independence have done it by doing “hitting singles” consistently. A pile of money didn’t drop on their lap from a long-forgotten uncle. Lady luck didn’t grace them on the lottery numbers they played. Instead, they mastered the basics. And here’s the kicker: You can do it, too and I will show you how.

If you’ve been a reader of mine for some time (both here and on BiggerPockets), you know I like to present case studies of how investors can reach financial independence by building real estate portfolios that produce $50-$100k in passive income. I frequently get bristling responses after those posts are published from readers that see the large numbers on display and cannot fathom how they could possibly replicate that performance. “How am I supposed to save all that capital on my $_______/year salary?”.

Listen, I get it. It can seem overwhelming when a real estate investing case study is presented from a 10,000 ft view and you see large figures being thrown around like it’s nothing. Also, I’m not oblivious to the fact that it is substantially easier for someone making $200k/year to save money for investments than someone making a quarter of that. But I also know that while a higher income does impact how fast an investor can save up capital, the principle that makes savings possible is exactly the same. And that powerful principle is this: The capital for your investments is nestled in your income statement like a fossil inside layers of rock. The tool that allows you to uncover that capital is your budget. The problem is the way you’ve been taught to budget is all wrong and doesn’t work. It’s time we fixed that.

The wrong way to budget

I might not know you but I have a pretty good idea about how you budget. Most likely, you write down your take-home pay for the month then you list all the current expenses where that money is being spent. The difference between the income and expenses is what you have available to save and invest and it’s usually not much. So, if you are trying to increase the amount you save you go through each expense and try to decide if that expense is absolutely necessary or if it can be cut from your budget. This usually yields very modest savings because it turns out all your expenses appear to be necessary and you can’t see how you can cut most of them.

There are three principal reasons why this budgeting method does not work.

Your budget prioritizes the wrong things

Take a look at the basic equation that governs your budget:

Income – Expenses = Savings

That equation is the main reason why you aren’t saving more of your income. In his excellent 2014 book Profit First (read first two chapters here), Mike Michalowicz talks about a behavioral principle called The Primacy Effect. It says we automatically place more importance and significance on what we encounter first. Therefore, when we think of our budget in terms of income minus expenses equals savings, we are hardwired to focus on income and expenses and leave savings to become an afterthought. That’s why the first thought that crosses our mind when we decide that we want to save more money is: I need to find a way to earn more.

This is a structural defect in the mental framework we have been taught about budgeting. If we want different results, we can turn the tables and put the Primacy Effect to work for us. So, instead of covering expenses and then saving what’s left, you should first save a target percentage of your income and spend what’s left. Therefore, the new and improved budget formula is Income – Savings = Expenses. This way, we make savings a foregone conclusion and then we figure out a way to make our lifestyle fit in the remaining amount allocated to expenses.

No one likes to be wrong

When you try to go over your current expenses and make a decision on which ones you should eliminate, there’s a very strong resistance that’s working against the decision to cut anything. And that resistance comes from the fact that if you decide an expense should be eliminated, you’re essentially admitting that you were wrong in making it in the first place. No one likes to admit that they were wrong. Therefore, as you’re going through the “elimination process”, your brain becomes a cacophony of rationalization. All of a sudden, you can think of perfectly good reasons why each and every expense is absolutely justified and untouchable. As a result, any cuts you make are minor and inconsequential.

Your budget needs structural work

What you’re currently attempting to do with your budget doesn’t work because you’re trying to make cosmetic repairs to a “building” that has structural damage. Instead of “lipstick”, it needs to be torn down and started over. You’re trying to work within a system that will not produce the results you want, no matter how many tweaks you attempt. If you want to increase your savings rate so you can invest in real estate and reach financial independence early, you need a completely new system.

So put down the pen you are using to redline through expenses and let me show you a better way to budget that prioritizes spending and investing and makes cutting expenses simple.

The Zero Budget

Take a blank sheet of paper and draw a line right down the middle.

On the left side at the very top, write your take-home income.

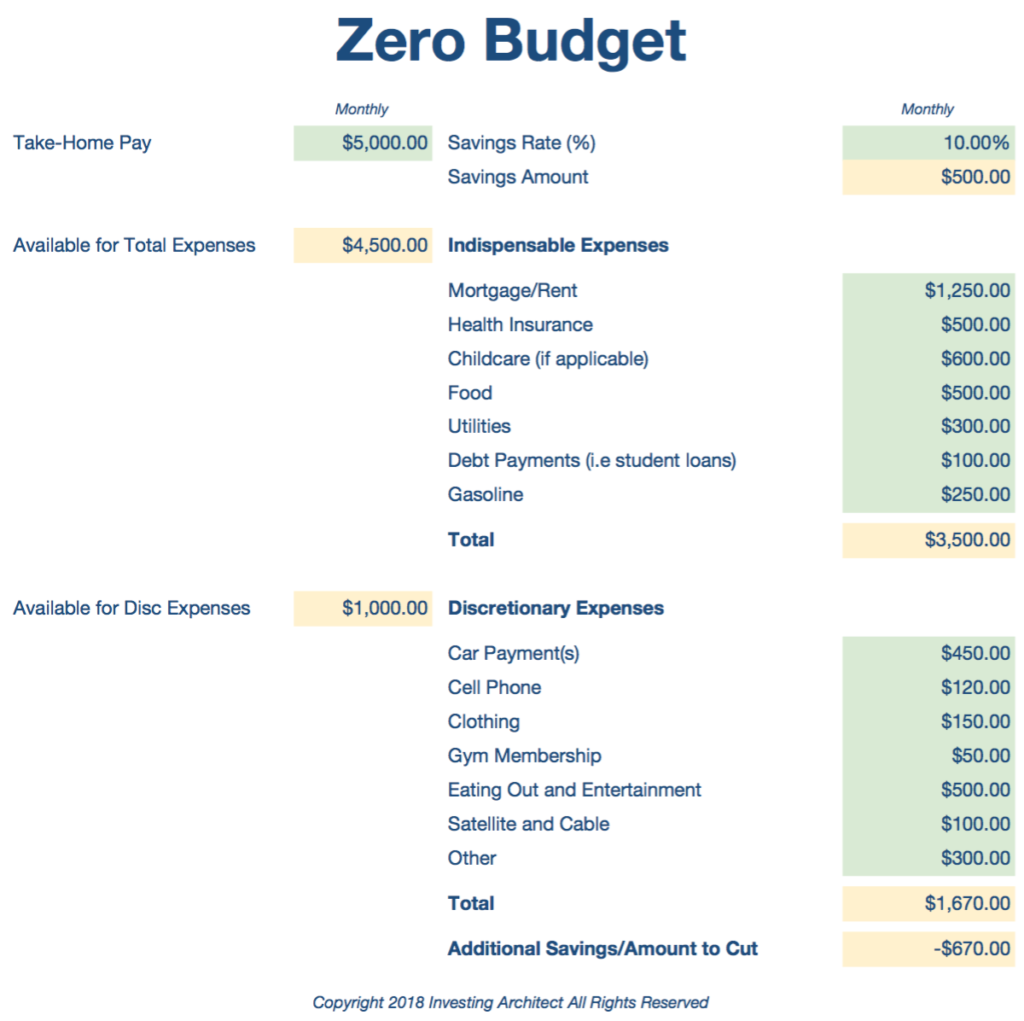

Then, decide what percentage of your income would you need to save each month so you can invest and reach financial independence early. You can start small and increase as you see more opportunity. For example, you can start with 10% of your take-home pay. If your income permits, do 15, 20 or even 30%. Multiply the savings percentage rate by your take-home pay and write that number on the right side at the very top.

Next, subtract the take-home income from savings to determine the Total Amount you have available for Expenses.

Then list and add all indispensable expenses. In this category belong expenses you can’t live without like rent/mortgage, health insurance, childcare, food, utilities, gasoline. Add it all up and subtract the total from your total amount available for Expenses. The result is what you have left to spend on discretionary expenses: car payments, debt payments, cell phone, eating out, cable/satellite, shopping, etc. Write this down on the left side of the sheet.

Finally, spend the remaining amount on the most important discretionary expenses until there are zero dollars left (hence the name Zero Budget). Everything that didn’t make the cut… well, it didn’t make the cut. There’s no more money left to spend. Therefore, if saving and investing is your first priority, you must eliminate the discretionary expenses that didn’t make the cut starting from the bottom and working your way up.

Critical Next Steps

If you’re truly committed to your journey toward financial independence, you must take some critical next steps to avoid this becoming an academic exercise. The first thing you want to do is automate your savings. Set up an automatic transfer from your paycheck into a savings account where the funds are purposefully hard to access. This will remove the burden of decision each month and you can’t spend what you don’t have available. This savings account now can become your source for emergency savings and investment capital.

The next critical step is to take action on the expenses you must cut right away. Call and cancel any recurring bills (i.e cable or that gym membership you haven’t used in months). Make a meal prep plan so you can avoid eating out as much. And so forth.

Finally, make an appointment with your self at the beginning of each month to review how you did on your previous month’s budget and to set the budget for that month. There’s always deviations from the plan – that’s normal. But if you create a habit of reviewing your budget regularly you will become more aware of your financial situation so you can make necessary adjustments.

One More Thing

Now that you’ve done the process by hand and understand the thinking behind it, I’ll make your job even easier.

Below is a screenshot of what the Zero Budget would look like in a spreadsheet that does all the calculations for you. And if you’d prefer using a spreadsheet instead of the slow (but necessary) torture of running calculations by hand, I’ll give you the spreadsheet I use. You can get the Zero Budget Spreadsheet if you click on the link. Be sure to make a copy of the Google Sheets file so you can use it for your budget.