If you are like most real estate investors that are getting started with their investment portfolio your number one fear is best contained in the question: What if I can’t find any Tenants?

Here’s a better question: What if you can find an investment property where you don’t have to worry about that?

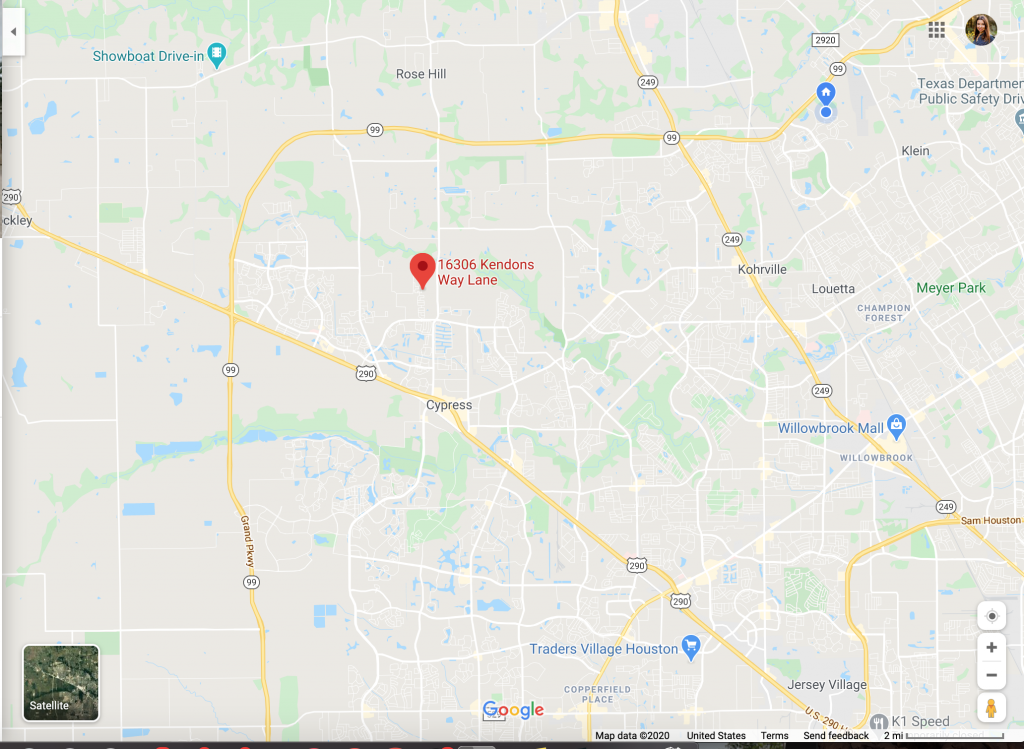

I want to share with you an investment opportunity that offers great ROI (18.2%) without the risks of buying a vacant property. This single family home is 100% Leased to long-term tenants who have been there since 2017. Even better, the Tenants don’t want to move and are willing to sign a lease extension. This investment property was built in 2004 and it is located in Cypress (77429 zip code). You will have cashflow on Day 1 even though your mortgage payments won’t begin until at least 30 days later.

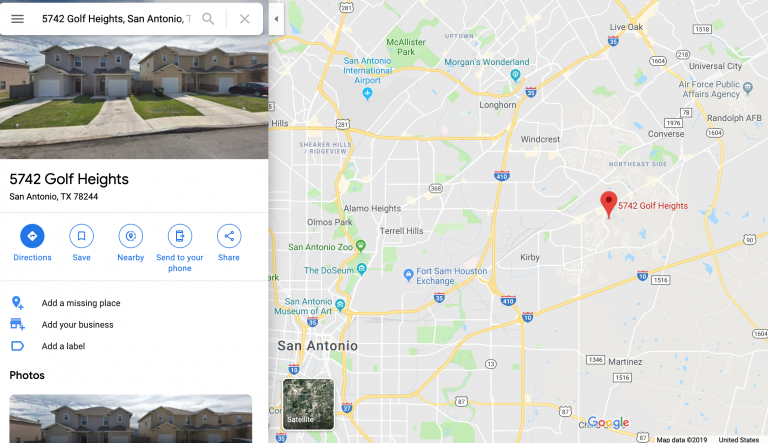

Property Photos

Cashflow Analysis

| Asking Price | $179,900.00 |

| Market Value | $179,900.00 |

| Purchase Price | $179,900.00 |

| Down Payment | $35,980.00 |

| Initial Repairs | $0.00 |

| Closing Costs | $3,598.00 |

| Investment Capital | $39,578.00 |

| Rent | $1,525.00 |

| Vacancy | $0.00 |

| Property Taxes | $374.58 |

| Insurance | $100.00 |

| HOA Fee | $25.00 |

| Maintenance and Repairs | $76.25 |

| Property Management | $0.00 |

| Leasing Fee | $63.54 |

| Landlord-Paid Utilities | $0.00 |

| Total Operating Expenses | $639.38 |

| Net Operating Income | $885.63 |

| Mortgage Payment @ 3.875% – 20% Down | $676.77 |

| Monthly Cashflow | $208.86 |

| Principal Paydown | $215.47 |

| Appreciation Return | $484.23 |

| Annual Depreciation Deduction | $5,235.09 |

| Total Monthly Return | $908.56 |

| 10-Year Annual Rate of Return | 18.18% |

| Cash-on-Cash Rate of Return | 6.33% |

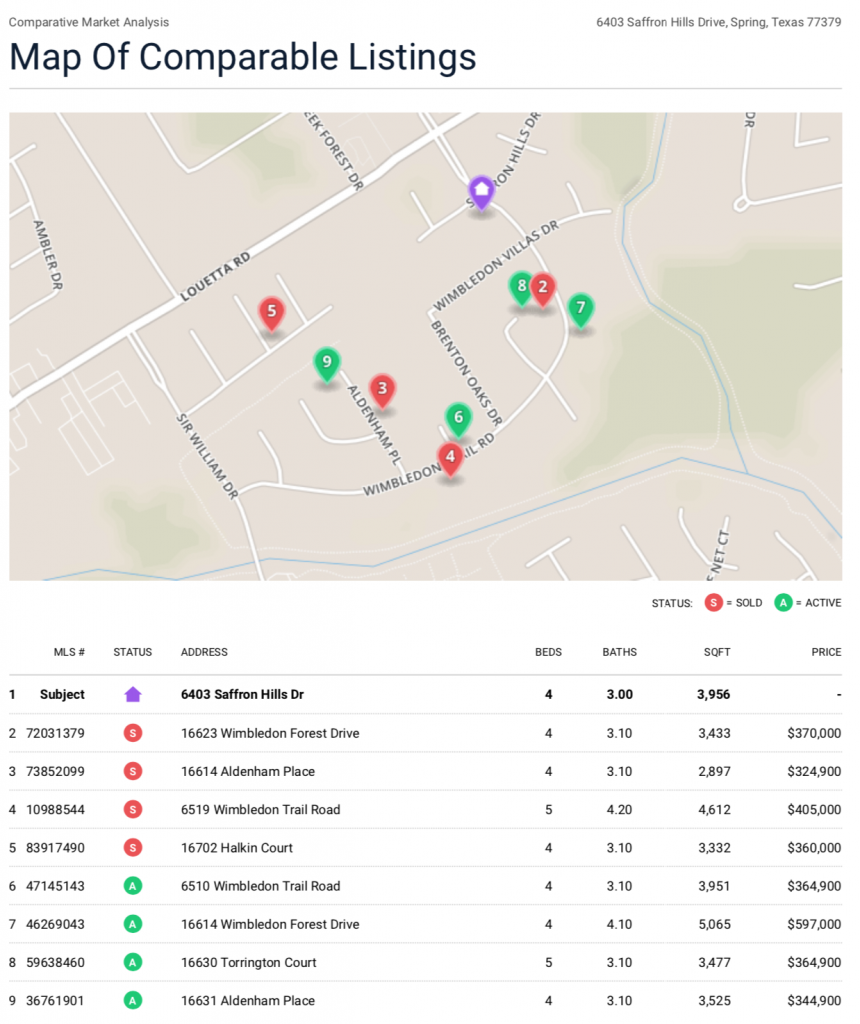

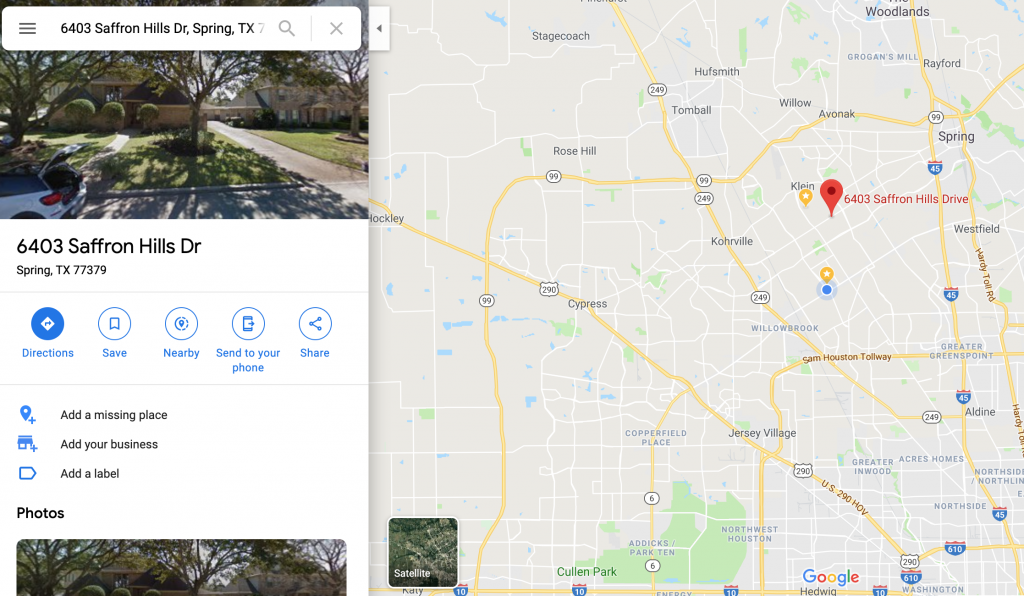

Map and Location

Downloads (PDF)

If you would like the detailed analysis that includes a 10 year cashflow projection plus market analyses for sale and rent please click the Download Buttons below:

Next Steps

If history repeats itself, I don’t expect this property to last very long. So if you are interested in this property give me a call at 713-922-2702.