The number one reason investors shun long term investing strategies is the perceived hassle of “landlording”. The concern is that this type of investment brings with it tenant calls at three o’clock in the morning, relentless maintenance, collecting trouble and the like. Since real estate investing success has as much to do with its return on investment as the overall investor experience, this is a valid concern that shouldn’t go unaddressed. So, I put together a list of 7 powerful tips to minimize the need for property management, eliminate hassle and increase your bottom line by saving on property management fees.

Property Management Tip 1: Buy New or Newer Properties

Most property management nightmares begin at the purchase. Seduced by “bargains” and equity, investors purchase three decade old properties with significant deferred maintenance and years of neglect. These “steals” often come with galvanized plumbing, electrical issues and air conditioning systems that have seen better days. Needless to say, these investors are setting themselves up for a bad experience that will often override any benefits brought by cash flow or captured equity. Instead, we advise our clients to purchase new or newer properties instead: Currently we don’t advise purchasing any properties built before 2005 (with some very rare exceptions). The reason behind this is that in a recently built home all major systems are also recent therefore less prone to breaking. Buy new (or newer) and avoid most issues that come with older properties.

Property Management Tip 2: Screen your Tenant well

This has to be both the simplest and most important property management tip in this list. Often in a rush to get the property occupied as soon as possible, investors will skip through the tenant screening process. Big mistake! The screening process uncovers whether or not the tenant has the financial ability or employment stability to afford the home or whether he/she has been a responsible tenant in the past. Inexperienced investors often view the tenants ability to afford the rent as the tenants problem, until it becomes their problem. In our practice we thoroughly screen tenants often rejecting several applications before accepting one that works. And that ends up being a win win for everyone: Our clients get a tenant that pays on time and takes good care of the property and the tenants get into a property they love and can comfortably afford.

Property Management Tip 3: Require Bank Deposits for rent payments

The advancement of banking technology in recent years can help real estate investors collect rent effortlessly and keep their tenants accountable faster. It used to be that tenants would mail a check which the landlord would receive and have to make another trip to the bank to deposit it. If a week passed and the rent check wasn’t there, the landlord would call and be told the check was in the mail. Ten days later, still no check and the tenants were then facing a situation where they would have to pay two months rent in quick succession so they’d skip out and rent a different property somewhere else. No more. Now we advise our clients to require that the tenant make a bank deposit or transfer straight into the landlords account. The tenant gets a deposit slip which serves double duty as a receipt and the landlord can log on to their Online Banking to make sure the deposit was made. If rents not there, it wasn’t put there and the landlord can hold the tenant accountable faster and collecting faster. Then, if the investor has their mortgage payment automatically deducted from that same account, they have a seamless system in their hands.

Property Management Tip 4: Buy and keep a home warranty policy at all times

Home warranty policies are an investor’s best friend. They work like an insurance policy: The client pays an annual premium (typically $300-400) and the home warranty company covers all major systems like the HVAC, plumbing, electrical, appliances etc. For every service call, there’s a $50-65 service charge and the rest is covered. So say the A/C stopped cooling: The tenant would call the 1-800 number for the home warranty company, they would send in a service technician next business day, the repair would be completed and all that would be owed is the minimal service charge. Having a home warranty only works seamlessly if you follow Tip #1 and buy a new or newer property. If instead your AC system was installed when Reagan was president, the home warranty company can decline coverage based on pre-existing condition. But this strategy has worked amazingly well for our clients. But what it the tenant has a knack for arranging service calls for every little thing? That issue is solved by our next tip.

Property Management Tip 5: Include a reasonable repair deductible in the lease

You want to make sure that the tenant has a vested interest in maintaining the property well. One way to do this is to always collect an appropriate security deposit. Another is the include a repair deductible clause in the lease. Typically our clients request the first $100 of repairs to be covered by the tenant (except on those repairs mandated by law to be covered by the Landlord in entirety). This ensures that the tenant doesn’t call you for very minor repairs every other day and it aligns the Landlord’s and Tenant’s interest in proper property preservation. Also, this clause when combined with Tip# 4 above, allows for repairs to be fully completed without the investor having to hear about it or pay for it as the deductible would cover the service charge for the home warranty.

Property Management Tip 6: Setup a separate phone number for repair calls

In an attempt to be helpful and accessible, investors often provide their home or mobile phone information for repair requests to their tenants. This inevitably leads to those infamous phone calls at 2am. There’s a better way. It starts with educating the Tenant on how the process should go once there’s a repair request. The investor needs to clearly communicate that the fastest way to take care of the issue is to call the home warranty company directly and setup a service call. For other concerns, the investor should setup a dedicated, separate phone number. This doesn’t need to be a physical line – instead it can be a virtual phone number through Google Voice. This service allows you to get a free local phone number with voicemail. If the the tenant calls and leaves a voice message, that message is automatically transcribed and emailed to the investor. If the issue is truly an emergency, the investor can take immediate action. If not, they can choose to address it the following day on their terms. Having a dedicated, virtual phone number puts the investor in control and minimizes hassle.

Property Management Tip 7: Use a-la carte vendors as needed

Sometimes, even after taking all the necessary precautions and doing everything right, investors often find themselves in a position where they have to deliver a notice to vacate or proceed with eviction. The process can be arduous and frustrating but the good news is the investor doesn’t need to be involved in it. In every market, there are companies that offer these services on a need to do basis. Need to deliver a notice to vacate? You can pay $59 and have it delivered for you. Need to follow through with eviction? $500 will get it done. The crucial point is that you are only paying for these services if and when you need them. Instead, if you hire a professional management company, you will pay a portion of your gross rent every month whether anything needs to be done that month or not.

Hope you found these tips as powerful as I’ve seen them to be in my practice. But in the end, self management, just like professional management isn’t for every one. That decision depends on many factors: location of investor, number of investment properties, and investor inclination.

If there any any property management concerns you would like me to address, please comment below and I will be happy to help.

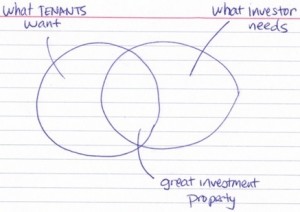

Ben Stein said it best: In order to get what you want you first have to know what you want. In working with numerous clients, I’ve found that coming up with an identikit, that is, a rough sketch of the characteristics the property should have makes the process of identifying the property a lot easier. Great investment properties are found in the intersection between what tenants are looking for in a great property and what the investor needs for the property to make business sense. By blending some of the property characteristics that prospective tenants want with some of the business characteristics of what you need, you will select a winner every time.

Ben Stein said it best: In order to get what you want you first have to know what you want. In working with numerous clients, I’ve found that coming up with an identikit, that is, a rough sketch of the characteristics the property should have makes the process of identifying the property a lot easier. Great investment properties are found in the intersection between what tenants are looking for in a great property and what the investor needs for the property to make business sense. By blending some of the property characteristics that prospective tenants want with some of the business characteristics of what you need, you will select a winner every time.