Do you ever wonder about the decision making process that a company like Starbucks goes through when deciding where to put their new store? Think about it for a second. Opening a new store involves tremendous costs: hundreds of thousands spent on building out the store, millions of dollars committed to a long term lease and thousands of man hours spent on hiring and training the new staff. Needless to say, it’s a pretty big decision that the company HAS to get right. But as any commercial real estate broker will tell you, every retail space owner wants to lease to Starbucks. So with all these options at their disposal, on what do they base their decision? Do they just wing it or “play it by the gut”? Not a chance.

In a much smaller scale, that’s a very similar problem that a real estate investor faces when trying to decide where to invest their hard earned capital. A real estate investor may not spend millions of dollars on a property like Starbucks does, but relative to the investor’s means, this decision is just as crucial if not more. Even within a single market, like Houston, there are hundreds of different ways to put that capital at work. Does the investor put their money into cheap properties that are riskier but cashflow well or is it better to invest into premium locations that have higher appreciation rates but lower cashflow? What about a middle ground solution? And that’s not even all of it. Do you buy older properties or new construction? Suburbs or Inner Loop? Decisions decisions. Problem is, unlike Starbucks, many investors do wing it. Either because they didn’t get the right advice or didn’t get any advice they end up squandering an opportunity that if utilized correctly would get them to retirement in a decade.

Back to Starbucks. So they have all these options – how do they make the right choice. They put the horse before the cart. Before deciding on the supply (store) they get to know their demand (customers). They know their customers’ demographics: Their age, their employment, their income, their family composition. But they also know their customers psycho-graphics: Their spending habits, their disposable income, their drive time to get coffee etc. Once they know their demand, they analyze potential sites to see how they fit their customer base. Will there be enough potential customers within a 5 minute drive time to meet sales goals for the store? If not, they move on to the next site until they find the right mix of demand for the supply they’re providing.

Most real estate investors do this backwards. They find a cheap enough property, buy it then try to figure out how to get their desired great tenants into that property. They never bother to figure our their demand. Sure, they want great tenants who will lease their property long term, pay rent on time and take care of their property like it were their own. However, unlike Starbucks, they don’t know their customers and what they’re looking for in a rental property. They don’t know their demographics or psychographics and they have no idea if there’s enough potential tenants that might be interested in that particular location. And if they got the location right by chance, they don’t know what level of upgrades and amenities these tenants expect in a rental property.

The moral of the story is that your real estate investing results will always outperform if you learn your demand first then supply it than vice versa. By the time we advise our clients on a particular location, we have already done rigorous research on the property and determined that the demand is there for the supply we’re trying to acquire. Case and point:

Above is a tapestry study of a property we recommended to one of our clients to purchase. This is a psychographic analysis of people that live within 0.5, 1 and 1.5 miles of the property (circles). In the immediate vicinity of the property there are three lifemode groups:

L7 High Hopes: Young households striving for the “American Dream”

L2 Upscale Avenues: Prosperous, married couple homeowners in different housing

L1 High Society: Affluent, well-educated, married-couple homeowners

So if I’m purchasing an asset located in this area, does the psychographic profile of the population match the type of tenant I’m looking to find? Take that one further:

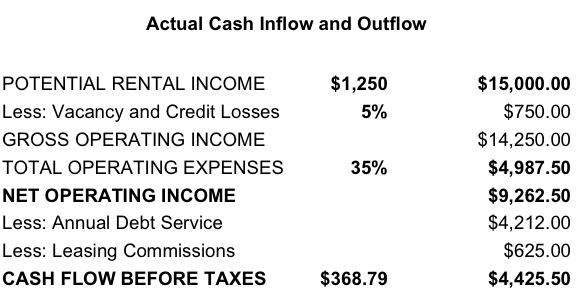

The above demographic report provides even more information on the demand aspect of the equation. For instance, it tells me that over 70% of the population in the area makes between $50k and $150k. That info is very important when you compare it to the rent you are going to ask for the property. Do people that live in the area generally make enough to support the rent?

Last week I asked you a question: Who’s advising you about your real estate investments? The quality of the advice will determine the results you get. And the quality of the advice is dependent on the research your adviser does even before you take a look at the property to answer the questions you didn’t even think to ask.