Martin came to us referred from a personal friend and previous client of ours in the fall of 2009. He was in his late twenties, had graduated from college with an engineering degree about five years back and started working for a national consulting firm in the East Coast. He was a saver who had heard about the benefits of real estate investing in Texas, had a well defined set of goals, as most engineers do 🙂 but was looking for a pathway to achieve them. What follows is a case study of the Blueprint investing strategy I crafted for him, the execution of that strategy and most importantly the results it produced. If you identify some of yourself in these lines, it is my hope that this story can shed some light into what’s possible with a well structured, long term investment strategy and flawless execution.

Recalibrating his aim

On our first phone call, all he could talk about was cash flow. “I want to buy four investment homes in the next two years, rent them out for positive cash flow. I want to build enough cash flow, so I can do whatever I want and live off the cash flow”. You get the gist. So, we had to have a come-to-Jesus meeting. We started focusing on the “Why and When” rather than the “How”. It was immediately evident that Martin wanted to put together a solid portfolio of real estate investments that would produce enough cash flow at some point in the future to make him financially free. Just like it became painfully obvious that he didn’t need the positive cash flow right now to subsidize his income or pay his bills. He was right to want cash flow. It was the timing that was misconstrued.

The Eureka! moment came when I proceeded to explain what his beloved cash flow truly was: the return on capital. For instance, if you have $100K in available capital (a.k.a cash) and you invest it in a real estate portfolio that has a return on investment of 15%, your cash flow will be $15,000/year. While it does give you the ability to thump your chest that you’re out earning your friends’ 401Ks and CDs, $15K isn’t exactly financial freedom. So how do we achieve retirement or financial independence through real estate investing? We have to grow the capital first, to increase the amount of cashflow we draw on it later. If we managed to grow our capital from $100K to $400K, that same portfolio would return $60K/year. Sounds like we’re getting closer, doesn’t it?

Laying out the Blueprint

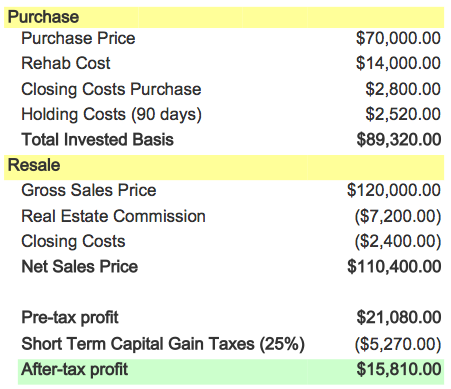

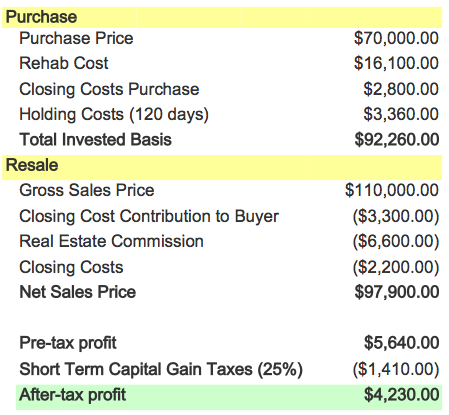

How do you grow your investing capital from $100K to $400k in 10 years? You execute the Blueprint. Over the next 24 months, Martin was to acquire four investment properties strategically located in specific areas with excellent schools, location and access to attract a good tenants. Two of the properties closed in 2010, the other two in the first quarter of this year. They were all leased out within four weeks of being placed on the market. Average price of the properties was $100K. Below is the actual breakdown on one of the properties:

Looks pretty good, doesn’t it? Funny thing is, the true magic lies into what comes next. If you put together a portfolio of four properties that have more or less the same numbers as the above breakdown, you have created $1600/mo in positive cash flow. Since our goal is to grow the capital now so we can draw a greater return (cash flow) on it later, we will put the current positive cash flow stream to work. The goal is to accelerate the payoff of the debt on the portfolio by executing a laser focused domino strategy. That is, we apply the positive cash flow as additional principal payment to pay off the mortgages on the properties one at a time. To use the example above, an $82K mortgage would be paid off in 44 months (little over 3.5 years) if we paid an additional $1600/mo toward the principal. This is when the dominoes start falling even faster. Now that the mortgage is paid off on that property, your available cashflow to “attack” the second property increases to $2,038/mo. At that rate of principal payments, the second property is completely paid off in 35 months. And so forth.

When Martin is done executing this Blueprint, his entire portfolio is projected to be debt free in 11.2 years. If we don’t account for any property appreciation, his real estate investment portfolio would be worth 4 times what he started with at a cool $400k+. If rents don’t increase one penny in 11 years (highly unlikely), Martin would collect over $40K in annual cash flow. All of that before his 40th birthday.

Are you ready to get an early start on your real estate investing? Let’s talk. Call me at 713.922.2702

Photo Credit: RonanCantwell

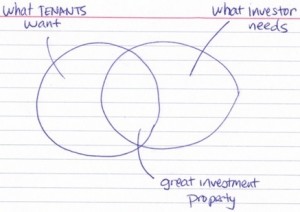

Ben Stein said it best: In order to get what you want you first have to know what you want. In working with numerous clients, I’ve found that coming up with an identikit, that is, a rough sketch of the characteristics the property should have makes the process of identifying the property a lot easier. Great investment properties are found in the intersection between what tenants are looking for in a great property and what the investor needs for the property to make business sense. By blending some of the property characteristics that prospective tenants want with some of the business characteristics of what you need, you will select a winner every time.

Ben Stein said it best: In order to get what you want you first have to know what you want. In working with numerous clients, I’ve found that coming up with an identikit, that is, a rough sketch of the characteristics the property should have makes the process of identifying the property a lot easier. Great investment properties are found in the intersection between what tenants are looking for in a great property and what the investor needs for the property to make business sense. By blending some of the property characteristics that prospective tenants want with some of the business characteristics of what you need, you will select a winner every time.