Last week, I was having lunch at Houston’s in the Galleria with an old friend that I hadn’t seen in a while. After some catching up, he revealed that after 15 years of two steps forward three steps back, his retirement had grown by just $10K. Not good. So, he was strongly considering investing in real estate long term (good call!) but just didn’t know where or how to start. That’s all the invitation I needed – The notepad was out and over the next two hours (that felt like 15 minutes) I laid out what I thought was the right strategy for his goals. I could see the “gears” in his mind spinning faster than the RPMs on a Maserati. It all made sense to him. Then he asked THE question: How do you find a great investment property? It’s a great question I get every single time with an investor that’s just starting out. The following is my response to that question.

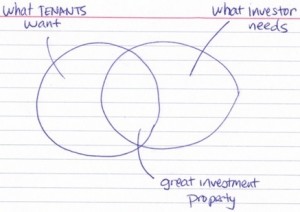

At the heart of it, the answer is based on supply and demand. Essentially, you are trying to purchase an asset (supply) that will generate rental income based on how desirable it is to prospective tenants (demand). So the answer will depend on the answers to the following questions:

What are tenants looking for in a property to lease?

Try putting yourself in a tenant’s shoes for a moment. Why are the reasons you are making the move from an apartment (or living with family) to a home?

- School District – Tenants want their children to attend the best public schools that their budget will allow. So we start by looking a school district rankings, parent reviews etc. Note: The quality of the school district is not negotiable for a long term real estate investor. This is a mistake that investors without an overarching strategy make often by chasing cheap homes that come with lousy schools.

- More Space – Imagine living in a 700 sf apartment with your spouse and a little one on the way. Or, picture your stuff bursting at the seams in that 400sf of rented space. Tenants often move because they want some more space to stretch out, maybe a backyard and a garage. So you look for properties that have at least 3 bedroom 2 bath 2 car garage and 1500Sf+ of living space with a reasonable yard.

- Good Location – Proximity to workplace, access to major thoroughfares, availability of shopping, dining and entertainment are all factors that tenants take into account when leasing. So it would make sense to acquire properties in neighborhoods that are well appointed, close to highways and tollways with lots of grocery stores, restaurants, movie theaters and the like.

- Neighborhood Amenities – In addition to leasing a home, the tenant is seeking the lifestyle that the home provides via neighborhood amenities. Community pools, playgrounds, walking trails, lakes etc. are what attracts good tenants and keeps them staying in your property longer.

- Floor plan – Last, the functionality of the floor plan and the way it flows deeply affect the tenant’s immediate interest in their first visit to the property. You can get by with what I call a “unit”, basically a box, but that’s not smart in the long run. And remember, you can’t remodel floor plan unless you want to get into the construction industry

What are you looking for in an investment property?

All the criteria mentioned above is very important but in the end it’s got to make business sense

- Growth Potential – You want to purchase a property that will not only preserve its value but appreciate in value over the long term. This is where most of what your prospective tenants want overlaps with what you need. If you purchasing a property with a nice floor plan within a great school district, well located within a neighborhood with great amenities will ensure that you capture the most appreciation over time. Don’t forget: Growing your capital is first priority within your Blueprint (long term strategy).

- Cash flow– The final destination of your plan is about passive cash flow and lots of it. Whether you try to create intermittent cashflow to accelerate the growth of your capital now or income to live comfortably once the Blueprint is executed, you’ve got to manage two aspects:

- Balanced Operating Costs – You could achieve everything a tenant wants in a great property by purchasing a $600K home in The Heights but it would make a horrible investment property for you. The operating costs: Taxes, Insurance, Vacancy etc. in that property are much too high. Most importantly they’re imbalanced vs. the rent you stand to get in those areas. In other words, it would take $6,000/mo rent to make that work and the chances of that are zip. Well balanced operating costs vary in the 40-50% range depending on the home. That will limit the home price to $100-$170K in the Houston area depending on location.

- Low maintenance Costs – You want to keep your maintenance costs as low as possible and you achieve that by purchasing properties that are recently built. The reason is, you don’t have to replace major systems, roof, A/C, plumbing in a property that’s five years old. If I had a dime for every time I see an investor purchasing a cheap 70s home then complaining about excessive repairs …

- Low (or No) Vacancy – Here again you can orchestrate a win win by purchasing a property in an area where there’s high tenant demand with great amenities. Also, setting a fair price and reasonable rent increases help maintain the vacancy low. Last but not least, being very selective with whom you decide to lease the property can make the difference between turnover and no vacancy for 3-5 years.

The identikit of a great investment property

Ben Stein said it best: In order to get what you want you first have to know what you want. In working with numerous clients, I’ve found that coming up with an identikit, that is, a rough sketch of the characteristics the property should have makes the process of identifying the property a lot easier. Great investment properties are found in the intersection between what tenants are looking for in a great property and what the investor needs for the property to make business sense. By blending some of the property characteristics that prospective tenants want with some of the business characteristics of what you need, you will select a winner every time.

Ben Stein said it best: In order to get what you want you first have to know what you want. In working with numerous clients, I’ve found that coming up with an identikit, that is, a rough sketch of the characteristics the property should have makes the process of identifying the property a lot easier. Great investment properties are found in the intersection between what tenants are looking for in a great property and what the investor needs for the property to make business sense. By blending some of the property characteristics that prospective tenants want with some of the business characteristics of what you need, you will select a winner every time.

I have the experience and know-how to show you and help you find a great investment property to start or expand your portfolio. Call me on my cell at 713.922.2702 and let’s talk.

In this series of posts so far, I’ve addressed how to prepare and position yourself for your first investment property purchase and how to find investment properties in Houston. Next, I’m planning to write a “meat and potatoes” post about how to properly analyze an investment property. Don’t touch that “dial” (whatever that means) 🙂

Photo Credit: HokutoSuisse