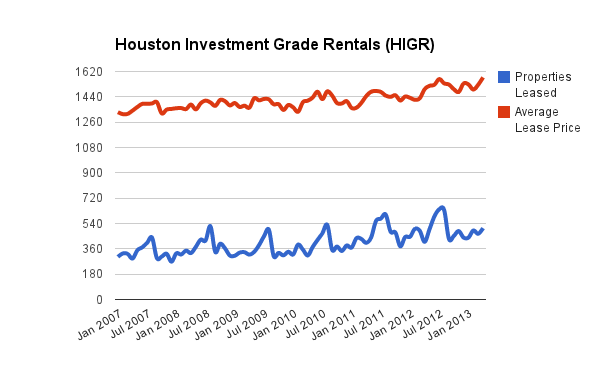

Every year since 2007, the number of properties leased during the month of April had been 8-10% lower than the corresponding March figure.

This year, the Houston rental market shattered this well-established trend. According to statistics obtained directly from the MLS for investment grade rental properties, a total of 507 single family homes were leased during the month of April. That figure represents a 24% increase year over year and an 8% jump over last month.

The solid jump in units leased was certainly welcome news. But was this increase as a result of higher demand or lower prices? The numbers answered that question emphatically in April. Average rents climbed to $1578 per month – a 6% increase year of year and a 3% jump over March 2013. Not only that, but the April average rent is the highest rent on record. So clearly, organic tenant demand is the culprit not reduced rents.

Average days on market came in at a low 27 days – on par with both April 2012 and last month.

Available inventory of investment grade properties for lease dropped to 465 homes (down from 507 on April 1) on the back of the increase in units leased. When we look at the average units leased over the last 12 months, that number comes in right at 500 properties/month so there’s less than 30 days inventory on the market. The current supply demand relationship points to further strength in the rental market for investment grade properties in the months to come.

To view our interactive Houston Investment Grade Rentals (HIGR) Chart click on the chart image above.