Two 100% Leased Duplexes with Tenants and Management in place conveniently located in the same community in Northeast San Antonio market located minutes from Randolph Air Force Base & Ft. Sam Houston. Perfect for a 1031 Exchange or an investor looking for cashflow on Day 1. They would make a great package since they are in the same neighborhood but they can be purchased separately.

3 bedroom 2.5 bath with a 1 car garage on each side. Tray ceilings with crown molding in the living room. Granite countertops and all black appliances in kitchen. Nice privacy fenced backyard. Ceramic tile on the first floor with carpet upstairs

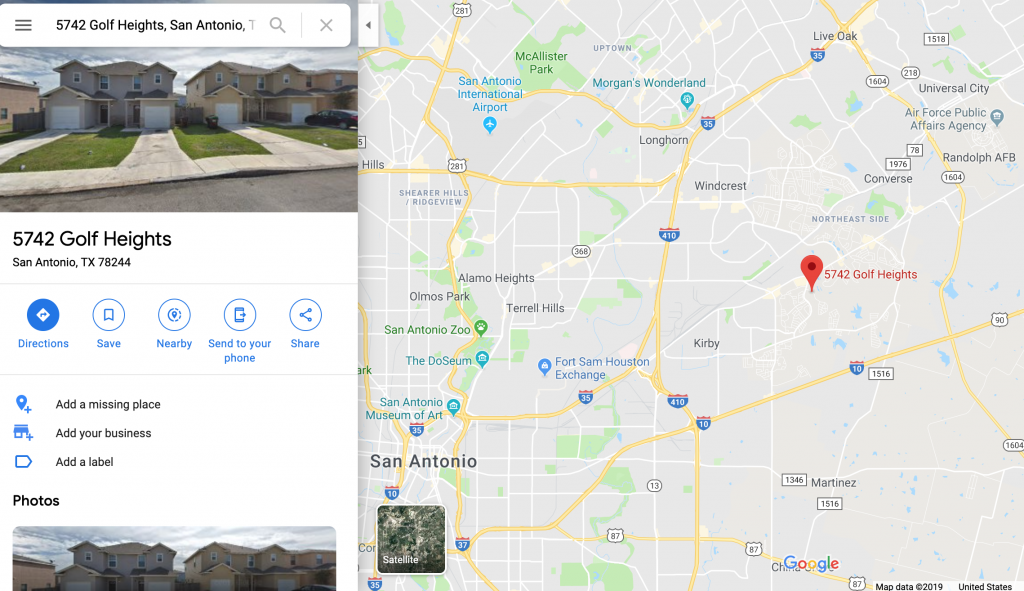

Map and Location

Financial Breakdown

| 5742 Golf Heights, San Antonio TX | |

| 6 Bedrooms 4 Baths | Year Built: 2016 |

| School District: Judson ISD | Size: 2492 SF |

| Property Type: Duplex | Market: San Antonio |

| Price/SF: $ 112.16 | Rent/SF: $ 0.89 |

| Asking Price | $279,500.00 |

| Market Value | $295,000.00 |

| Purchase Price | $279,500.00 |

| Down Payment | $69,875.00 |

| Closing Costs | $8,385.00 |

| Investment Capital | $78,260.00 |

| Rent | $2,225.00 |

| Property Taxes | $372.25 |

| Insurance | $83.33 |

| HOA Fee | $33.00 |

| Maintenance and Repairs | $66.75 |

| Property Management | $111.25 |

| Total Operating Expenses | $666.58 |

| Net Operating Income | $1,558.42 |

| Mortgage Payment @ 4.375% – 25% Down | $1,046.63 |

| Monthly Cashflow | $511.79 |

| Principal Paydown | $287.55 |

| Appreciation Return | $752.32 |

| Annual Depreciation Deduction | $8,584.50 |

| 10-Year Annual Rate of Return | 17.64% |

| Cash-on-Cash Rate of Return | 7.85% |

| 5623 Golf Mist, San Antonio TX | |

| 6 Bedrooms 4 Baths | Year Built: 2016 |

| School District: Judson ISD | Size: 2492 SF |

| Property Type: Duplex | Market: San Antonio |

| Price/SF: $ 115.97 | Rent/SF: $ 0.88 |

| Asking Price | $295,000.00 |

| Market Value | $295,000.00 |

| Purchase Price | $289,000.00 |

| Down Payment | $72,250.00 |

| Closing Costs | $8,670.00 |

| Investment Capital | $80,920.00 |

| Rent | $2,200.00 |

| Property Taxes | $372.25 |

| Insurance | $83.33 |

| HOA Fee | $33.00 |

| Maintenance and Repairs | $66.00 |

| Property Management | $110.00 |

| Total Operating Expenses | $664.58 |

| Net Operating Income | $1,535.42 |

| Mortgage Payment @ 4.375% – 25% Down | $1,082.20 |

| Monthly Cashflow | $453.22 |

| Principal Paydown | $297.33 |

| Appreciation Return | $777.89 |

| Annual Depreciation Deduction | $8,584.50 |

| 10-Year Annual Rate of Return | 16.25% |

| Cash-on-Cash Rate of Return | 6.72% |

Downloads

If you would like the detailed analysis that includes a 10 year cashflow projection, rent roll, and the interest rate quote we used for the mortgage rate, please click download below:

If you’re interested, please contact us or if you’re seeing this in your email, hit reply.

Leave a Reply