This may come as a surprise but in my experience, most real estate investors don’t know how to properly calculate the return on investment on a particular piece of property. Couple that with the fact that ROI is the metric most investors use to make crucial decisions about investing and you have a recipe for disaster. Or at the very least, a recipe for missed opportunities.

First, let’s illustrate how most investors calculate the return on investment by looking at an example. Suppose there’s a property in a good location, zoned to good schools with nice finishes on the market for $160,000. A look at rent comparables in the immediate neighborhood reveals that the property should rent for $1650/mo ($19800/year) within a 30 day timeframe. Operating expenses, vacancy provisions and leasing fees add up to 40% of gross rents. The loan on the property is a 30 year fixed conventional loan at 5% interest for 80% of the purchase price (down payment of 20%) so the annual principal and interest payments add up to $8,244/year. So after covering expenses and mortgage payments, there’s a projected annual cashflow of $3,636. To purchase the property, the investor would have to pay the 20% down payment ($32,000) plus loan closing costs ($3,000) for a total of $35,000.

At this point the investor takes the positive cashflow of $3636 per year and divides it by the invested cash of $35,000 and conclude that the return on investment on the property is 10.36%.

The return calculated by the investor in the example above only reflects the cashflow return on investment or as it’s commonly known “the cash on cash return”. Essentially, this method looks at the real estate investment as a sophisticated CD or dividend stock. You invested X amount in the CD and it paid out Y at the end of the year so therefore your return is X/Y.

The method just described is wrong not because it’s incorrect but because it’s inconclusive.

Here’s why the cash on cash return does not tell the whole story – It does not account for:

- The principal of the mortgage paid of during that year

- The fluctuations in rent price during the holding period

- The fluctuations in property value during the holding period

Let’s take them one at a time. Part of the debt payments on the mortgage goes towards paying down the principal balance of the mortgage. Therefore, ten years from the acquisition point the mortgage balance will not be the same as when you start. The cash on cash return figure completely neglects this very important benefit of investment real estate. That is, the ability to pay off the mortgage using rental income. Second, the cash on cash return calculation may be accurate during the first year of the investment since the rent and expenses are pretty much set. But as time passes and you change tenants, the rents don’t typically stay stagnant and neither do expenses. Rents usually follow an upward trend (they go up over time) but that’s not guaranteed. Sometimes rents go down – for instance, when there’s an oversupply of rentals and not enough tenants to go around. So the cash on cash return does not accurately depict what happens to your investment as rent prices fluctuate. Third, on a similar note, home prices don’t stay stagnant over the long term as the last recession duly reminds us. Remember, there are two returns we have to contend with: Return on investment and return of investment. If you acquire a low priced property in a neighborhood where values are likely to decline over the next 10 years, your cash on cash return is providing an inflated view of what your true return will be in the end. Because when the time comes to exit the investment, you will have to “give back” some of those returns by not being able to recover all the capital invested at the outset due to declining prices.

As a way to illustrate how poor of a measuring stick the cash on cash return can be, suppose for a minute that instead of a 30 year mortgage, the investor went for a 15 year mortgage instead to take advantage of more favorable terms. When the loan term is shortened, loan payments increase by about 40% wiping out any positive cashflow that was there. Does this mean this deal is not worth doing because now the cash on cash return is zero? More importantly, is zero the true return on this investment?

The short answer is absolutely not.

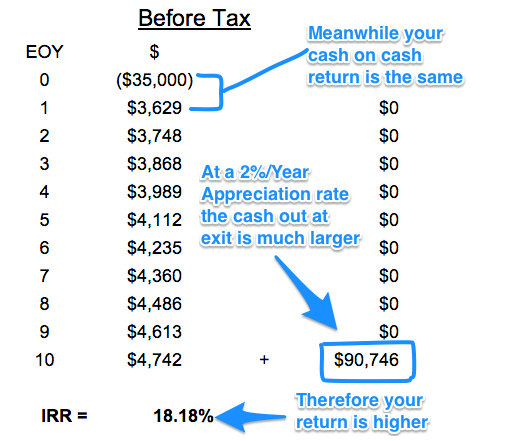

The proper way to calculate the return on a long term real estate investment is the internal rate of return. It’s not perfect, but it accounts for all those deficiencies I just went over. This method looks at an investment during the entire holding period and calculates an annual return. Take a look at the table below:

Think of this table as a chronological roadmap of your investment if you held it for 10 years then sold it. In the beginning, there’s your $35,000 investment (a negative number because it’s an outflow of cash) followed by ten years of cashflows and the cash you get back at the exit point if you sold the property for the same price you paid 10 years ago (zero appreciation over 10 years). As you can see, most investors just look at the first two numbers which don’t even cover half of the story.

Now let’s assume that the property went up in value at the rate of inflation (as most goods do) over the next 10 years. Take a look at the illustration above – your cash on cash return is the exact same but your true return has increased by 25%.

This may seem like a nerdy debate about methods of calculation but it’s much more important than that. The rate of return is usually THE metric most investors use to make decisions on investment opportunities. If you pass up on a worthy investment simply because your numbers aren’t right, that will have a negative impact in your investing results.